Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first quarter. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards South State Corporation (NASDAQ:SSB) to find out whether it was one of their high conviction long-term ideas.

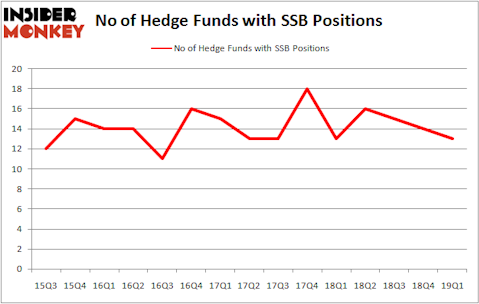

Is South State Corporation (NASDAQ:SSB) ready to rally soon? Prominent investors are getting less optimistic. The number of long hedge fund bets went down by 1 lately. Our calculations also showed that SSB isn’t among the 30 most popular stocks among hedge funds. SSB was in 13 hedge funds’ portfolios at the end of March. There were 14 hedge funds in our database with SSB holdings at the end of the previous quarter.

If you’d ask most market participants, hedge funds are viewed as worthless, outdated investment tools of years past. While there are greater than 8000 funds trading today, Our experts choose to focus on the upper echelon of this group, approximately 750 funds. These money managers direct bulk of the hedge fund industry’s total asset base, and by monitoring their unrivaled investments, Insider Monkey has spotted numerous investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s go over the recent hedge fund action surrounding South State Corporation (NASDAQ:SSB).

How are hedge funds trading South State Corporation (NASDAQ:SSB)?

At Q1’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -7% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards SSB over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Renaissance Technologies, managed by Jim Simons, holds the most valuable position in South State Corporation (NASDAQ:SSB). Renaissance Technologies has a $8.6 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is Forest Hill Capital, managed by Mark Lee, which holds a $7.5 million position; 2.3% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors with similar optimism encompass Matthew Lindenbaum’s Basswood Capital, Joe Huber’s Huber Capital Management and Bernard Horn’s Polaris Capital Management.

Since South State Corporation (NASDAQ:SSB) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there were a few money managers that elected to cut their full holdings heading into Q3. Interestingly, Amy Minella’s Cardinal Capital dropped the biggest stake of the 700 funds followed by Insider Monkey, comprising close to $24.9 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund dumped about $3.1 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 1 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to South State Corporation (NASDAQ:SSB). We will take a look at First Interstate Bancsystem Inc (NASDAQ:FIBK), Cadence Bancorporation (NYSE:CADE), Vonage Holdings Corp. (NYSE:VG), and ABM Industries, Inc. (NYSE:ABM). This group of stocks’ market caps are closest to SSB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FIBK | 11 | 93579 | -2 |

| CADE | 22 | 145431 | 4 |

| VG | 34 | 259024 | 12 |

| ABM | 8 | 22434 | -4 |

| Average | 18.75 | 130117 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $130 million. That figure was $26 million in SSB’s case. Vonage Holdings Corp. (NYSE:VG) is the most popular stock in this table. On the other hand ABM Industries, Inc. (NYSE:ABM) is the least popular one with only 8 bullish hedge fund positions. South State Corporation (NASDAQ:SSB) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on SSB as the stock returned 7.8% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.