The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 18.7% through May 30th, vs. a gain of 12.1% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Sanofi (NASDAQ:SNY), and what that likely means for the prospects of the company and its stock.

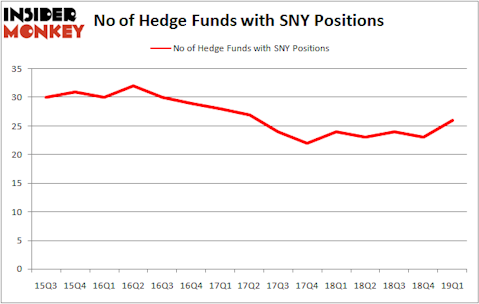

Sanofi (NASDAQ:SNY) was in 26 hedge funds’ portfolios at the end of the first quarter of 2019. SNY has seen an increase in hedge fund sentiment lately. There were 23 hedge funds in our database with SNY holdings at the end of the previous quarter. Our calculations also showed that SNY isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are several metrics investors employ to assess their holdings. A duo of the most under-the-radar metrics are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the elite money managers can outperform the market by a solid margin (see the details here).

Let’s check out the recent hedge fund action regarding Sanofi (NASDAQ:SNY).

Hedge fund activity in Sanofi (NASDAQ:SNY)

At the end of the first quarter, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SNY over the last 15 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in Sanofi (NASDAQ:SNY) was held by Fisher Asset Management, which reported holding $696.3 million worth of stock at the end of March. It was followed by Arrowstreet Capital with a $44.3 million position. Other investors bullish on the company included Point72 Asset Management, Eversept Partners, and Balyasny Asset Management.

As one would reasonably expect, key hedge funds were breaking ground themselves. Balyasny Asset Management, managed by Dmitry Balyasny, initiated the largest call position in Sanofi (NASDAQ:SNY). Balyasny Asset Management had $12 million invested in the company at the end of the quarter. Krishen Sud’s Sivik Global Healthcare also initiated a $5.8 million position during the quarter. The following funds were also among the new SNY investors: John Bader’s Halcyon Asset Management, Michael Gelband’s ExodusPoint Capital, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s now take a look at hedge fund activity in other stocks similar to Sanofi (NASDAQ:SNY). These stocks are Thermo Fisher Scientific Inc. (NYSE:TMO), NVIDIA Corporation (NASDAQ:NVDA), Royal Bank of Canada (NYSE:RY), and Altria Group Inc (NYSE:MO). This group of stocks’ market caps are closest to SNY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TMO | 68 | 4435544 | 1 |

| NVDA | 43 | 1595434 | 2 |

| RY | 17 | 552491 | 3 |

| MO | 36 | 823787 | -5 |

| Average | 41 | 1851814 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41 hedge funds with bullish positions and the average amount invested in these stocks was $1852 million. That figure was $860 million in SNY’s case. Thermo Fisher Scientific Inc. (NYSE:TMO) is the most popular stock in this table. On the other hand Royal Bank of Canada (NYSE:RY) is the least popular one with only 17 bullish hedge fund positions. Sanofi (NASDAQ:SNY) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately SNY wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); SNY investors were disappointed as the stock returned -4% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.