At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

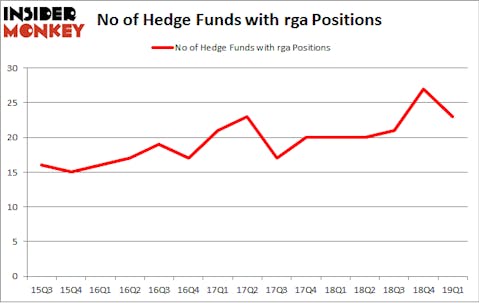

Reinsurance Group of America Inc (NYSE:RGA) investors should pay attention to a decrease in activity from the world’s largest hedge funds of late. Our calculations also showed that rga isn’t among the 30 most popular stocks among hedge funds.

At the moment there are plenty of signals investors use to assess stocks. A couple of the most innovative signals are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the elite investment managers can outperform the S&P 500 by a healthy margin (see the details here).

We’re going to take a gander at the fresh hedge fund action regarding Reinsurance Group of America Inc (NYSE:RGA).

How are hedge funds trading Reinsurance Group of America Inc (NYSE:RGA)?

At the end of the first quarter, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -15% from the previous quarter. By comparison, 20 hedge funds held shares or bullish call options in RGA a year ago. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

More specifically, AQR Capital Management was the largest shareholder of Reinsurance Group of America Inc (NYSE:RGA), with a stake worth $185.9 million reported as of the end of March. Trailing AQR Capital Management was Diamond Hill Capital, which amassed a stake valued at $53.8 million. Polar Capital, Citadel Investment Group, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Reinsurance Group of America Inc (NYSE:RGA) has experienced falling interest from the aggregate hedge fund industry, we can see that there were a few funds that elected to cut their full holdings by the end of the third quarter. At the top of the heap, Peter Seuss’s Prana Capital Management said goodbye to the largest investment of all the hedgies monitored by Insider Monkey, totaling an estimated $5.4 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund cut about $2.9 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 4 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Reinsurance Group of America Inc (NYSE:RGA) but similarly valued. These stocks are Molina Healthcare, Inc. (NYSE:MOH), VICI Properties Inc. (NYSE:VICI), Alleghany Corporation (NYSE:Y), and Carvana Co. (NYSE:CVNA). This group of stocks’ market values resemble RGA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MOH | 30 | 1026129 | 3 |

| VICI | 37 | 1927451 | -1 |

| Y | 23 | 306493 | 4 |

| CVNA | 41 | 1612623 | 7 |

| Average | 32.75 | 1218174 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.75 hedge funds with bullish positions and the average amount invested in these stocks was $1218 million. That figure was $409 million in RGA’s case. Carvana Co. (NYSE:CVNA) is the most popular stock in this table. On the other hand Alleghany Corporation (NYSE:Y) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks Reinsurance Group of America Inc (NYSE:RGA) is even less popular than Y. Hedge funds clearly dropped the ball on RGA as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on RGA as the stock returned 4.9% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.