Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Noble Energy, Inc. (NYSE:NBL) in this article.

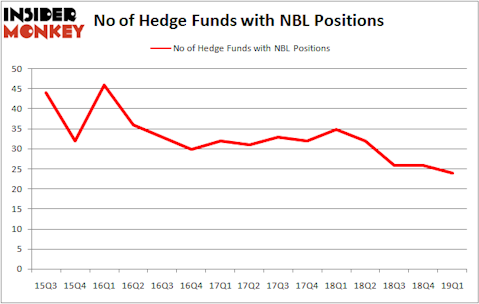

Noble Energy, Inc. (NYSE:NBL) shareholders have witnessed a decrease in activity from the world’s largest hedge funds in recent months. Our calculations also showed that NBL isn’t among the 30 most popular stocks among hedge funds.

To most shareholders, hedge funds are perceived as underperforming, outdated investment tools of yesteryear. While there are greater than 8000 funds with their doors open at present, We look at the aristocrats of this club, around 750 funds. It is estimated that this group of investors oversee the majority of all hedge funds’ total capital, and by watching their finest investments, Insider Monkey has revealed several investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a gander at the latest hedge fund action encompassing Noble Energy, Inc. (NYSE:NBL).

What does the smart money think about Noble Energy, Inc. (NYSE:NBL)?

Heading into the second quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from one quarter earlier. On the other hand, there were a total of 35 hedge funds with a bullish position in NBL a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Noble Energy, Inc. (NYSE:NBL) was held by Adage Capital Management, which reported holding $363.3 million worth of stock at the end of March. It was followed by Diamond Hill Capital with a $70.1 million position. Other investors bullish on the company included Millennium Management, SailingStone Capital Partners, and Alyeska Investment Group.

Since Noble Energy, Inc. (NYSE:NBL) has experienced falling interest from the entirety of the hedge funds we track, it’s easy to see that there is a sect of hedgies that decided to sell off their full holdings by the end of the third quarter. It’s worth mentioning that David Costen Haley’s HBK Investments cut the biggest position of the “upper crust” of funds tracked by Insider Monkey, totaling close to $10.8 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also dumped its stock, about $4.4 million worth. These transactions are interesting, as total hedge fund interest fell by 2 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to Noble Energy, Inc. (NYSE:NBL). These stocks are C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW), Nomura Holdings, Inc. (NYSE:NMR), CarMax Inc (NYSE:KMX), and NRG Energy Inc (NYSE:NRG). This group of stocks’ market caps are closest to NBL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHRW | 30 | 407519 | 3 |

| NMR | 5 | 36674 | 0 |

| KMX | 29 | 1641895 | 1 |

| NRG | 40 | 1792102 | -9 |

| Average | 26 | 969548 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $970 million. That figure was $615 million in NBL’s case. NRG Energy Inc (NYSE:NRG) is the most popular stock in this table. On the other hand Nomura Holdings, Inc. (NYSE:NMR) is the least popular one with only 5 bullish hedge fund positions. Noble Energy, Inc. (NYSE:NBL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately NBL wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); NBL investors were disappointed as the stock returned -11.8% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.