The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards News Corp (NASDAQ:NWSA).

Is News Corp (NASDAQ:NWSA) ready to rally soon? Money managers are taking a bearish view. The number of bullish hedge fund positions decreased by 2 recently. Our calculations also showed that nwsa isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the key hedge fund action surrounding News Corp (NASDAQ:NWSA).

How are hedge funds trading News Corp (NASDAQ:NWSA)?

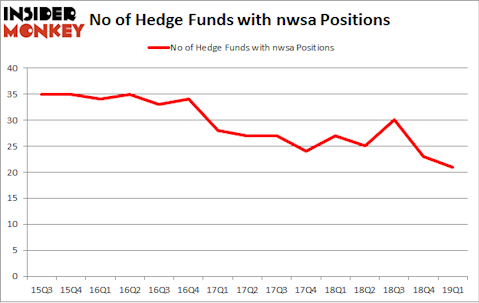

At the end of the first quarter, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NWSA over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Pzena Investment Management held the most valuable stake in News Corp (NASDAQ:NWSA), which was worth $274.1 million at the end of the first quarter. On the second spot was International Value Advisers which amassed $108 million worth of shares. Moreover, D E Shaw, AQR Capital Management, and Tensile Capital were also bullish on News Corp (NASDAQ:NWSA), allocating a large percentage of their portfolios to this stock.

Seeing as News Corp (NASDAQ:NWSA) has faced falling interest from hedge fund managers, it’s easy to see that there lies a certain “tier” of fund managers who sold off their full holdings by the end of the third quarter. Interestingly, Israel Englander’s Millennium Management said goodbye to the largest investment of the “upper crust” of funds watched by Insider Monkey, comprising close to $12.2 million in stock. Jeffrey Talpins’s fund, Element Capital Management, also dropped its stock, about $4.4 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to News Corp (NASDAQ:NWSA). These stocks are Enel Chile S.A. (NYSE:ENIC), Aspen Technology, Inc. (NASDAQ:AZPN), Unum Group (NYSE:UNM), and The Middleby Corporation (NASDAQ:MIDD). All of these stocks’ market caps match NWSA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ENIC | 5 | 31551 | -2 |

| AZPN | 25 | 1108955 | 0 |

| UNM | 25 | 373181 | 0 |

| MIDD | 20 | 656010 | 3 |

| Average | 18.75 | 542424 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $542 million. That figure was $518 million in NWSA’s case. Aspen Technology, Inc. (NASDAQ:AZPN) is the most popular stock in this table. On the other hand Enel Chile S.A. (NYSE:ENIC) is the least popular one with only 5 bullish hedge fund positions. News Corp (NASDAQ:NWSA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately NWSA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on NWSA were disappointed as the stock returned -8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.