Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

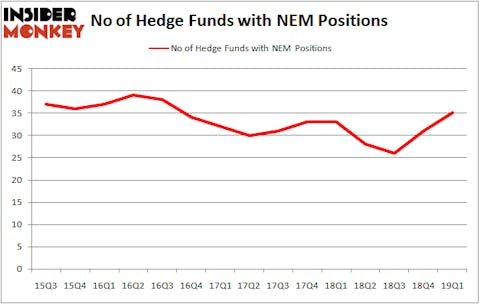

Newmont Goldcorp Corporation (NYSE:NEM) was in 35 hedge funds’ portfolios at the end of March. NEM has seen an increase in activity from the world’s largest hedge funds lately. There were 31 hedge funds in our database with NEM positions at the end of the previous quarter. Our calculations also showed that NEM isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are many metrics stock market investors can use to size up publicly traded companies. A pair of the less known metrics are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the top money managers can outclass the market by a superb amount (see the details here).

Let’s analyze the key hedge fund action regarding Newmont Goldcorp Corporation (NYSE:NEM).

What have hedge funds been doing with Newmont Goldcorp Corporation (NYSE:NEM)?

At Q1’s end, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards NEM over the last 15 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jim Simons’s Renaissance Technologies has the largest position in Newmont Goldcorp Corporation (NYSE:NEM), worth close to $192.3 million, amounting to 0.2% of its total 13F portfolio. The second most bullish fund manager is Millennium Management, led by Israel Englander, holding a $140.4 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism contain John Overdeck and David Siegel’s Two Sigma Advisors, Ken Griffin’s Citadel Investment Group and Cliff Asness’s AQR Capital Management.

Consequently, key hedge funds have jumped into Newmont Goldcorp Corporation (NYSE:NEM) headfirst. Stevens Capital Management, managed by Matthew Tewksbury, established the most valuable position in Newmont Goldcorp Corporation (NYSE:NEM). Stevens Capital Management had $10.6 million invested in the company at the end of the quarter. Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital also made a $6.5 million investment in the stock during the quarter. The other funds with brand new NEM positions are Wayne Cooperman’s Cobalt Capital Management, Jeffrey Talpins’s Element Capital Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s also examine hedge fund activity in other stocks similar to Newmont Goldcorp Corporation (NYSE:NEM). We will take a look at Best Buy Co., Inc. (NYSE:BBY), Essex Property Trust Inc (NYSE:ESS), AMETEK, Inc. (NYSE:AME), and Harris Corporation (NYSE:HRS). This group of stocks’ market valuations match NEM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBY | 35 | 1130058 | 12 |

| ESS | 16 | 447378 | -3 |

| AME | 29 | 1038604 | -3 |

| HRS | 25 | 783732 | 2 |

| Average | 26.25 | 849943 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $850 million. That figure was $787 million in NEM’s case. Best Buy Co., Inc. (NYSE:BBY) is the most popular stock in this table. On the other hand Essex Property Trust Inc (NYSE:ESS) is the least popular one with only 16 bullish hedge fund positions. Newmont Goldcorp Corporation (NYSE:NEM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately NEM wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on NEM were disappointed as the stock returned -8.1% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.