Is National Presto Industries Inc. (NYSE:NPK) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

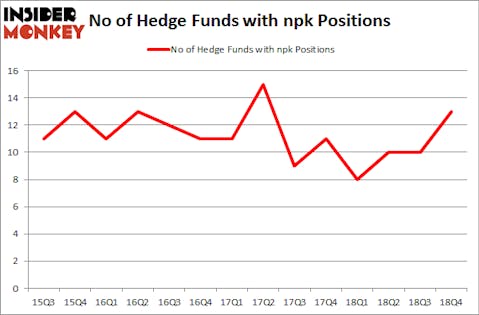

Is National Presto Industries Inc. (NYSE:NPK) a safe stock to buy now? Money managers are in an optimistic mood. The number of bullish hedge fund positions improved by 3 lately. Our calculations also showed that npk isn’t among the 30 most popular stocks among hedge funds. NPK was in 13 hedge funds’ portfolios at the end of December. There were 10 hedge funds in our database with NPK positions at the end of the previous quarter.

If you’d ask most traders, hedge funds are viewed as unimportant, old financial vehicles of the past. While there are greater than 8000 funds with their doors open at present, We look at the top tier of this club, about 750 funds. These hedge fund managers oversee bulk of all hedge funds’ total asset base, and by tailing their unrivaled equity investments, Insider Monkey has formulated numerous investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to go over the fresh hedge fund action encompassing National Presto Industries Inc. (NYSE:NPK).

How have hedgies been trading National Presto Industries Inc. (NYSE:NPK)?

At the end of the fourth quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 30% from the second quarter of 2018. By comparison, 8 hedge funds held shares or bullish call options in NPK a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Chuck Royce’s Royce & Associates has the most valuable position in National Presto Industries Inc. (NYSE:NPK), worth close to $67.4 million, corresponding to 0.6% of its total 13F portfolio. The second largest stake is held by Jim Simons of Renaissance Technologies, with a $13 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining members of the smart money that are bullish consist of Ken Griffin’s Citadel Investment Group, John Overdeck and David Siegel’s Two Sigma Advisors and Cliff Asness’s AQR Capital Management.

Now, key hedge funds were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the biggest position in National Presto Industries Inc. (NYSE:NPK). Marshall Wace LLP had $1.5 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also made a $0.3 million investment in the stock during the quarter. The only other fund with a new position in the stock is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as National Presto Industries Inc. (NYSE:NPK) but similarly valued. These stocks are Forrester Research, Inc. (NASDAQ:FORR), Independence Realty Trust Inc (NYSE:IRT), Penn Virginia Corporation (NASDAQ:PVAC), and Douglas Dynamics Inc (NYSE:PLOW). This group of stocks’ market values resemble NPK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FORR | 10 | 52714 | 1 |

| IRT | 9 | 50885 | -2 |

| PVAC | 16 | 274325 | -5 |

| PLOW | 7 | 7515 | 1 |

| Average | 10.5 | 96360 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $96 million. That figure was $95 million in NPK’s case. Penn Virginia Corporation (NASDAQ:PVAC) is the most popular stock in this table. On the other hand Douglas Dynamics Inc (NYSE:PLOW) is the least popular one with only 7 bullish hedge fund positions. National Presto Industries Inc. (NYSE:NPK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately NPK wasn’t nearly as popular as these 15 stock and hedge funds that were betting on NPK were disappointed as the stock returned -3.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.