Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

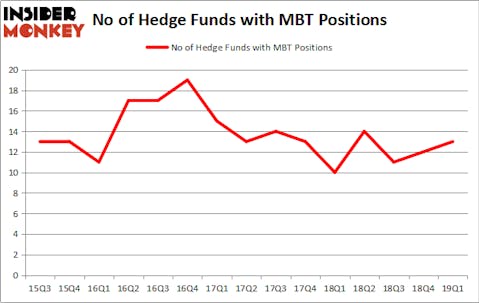

Mobile TeleSystems Public Joint Stock Company (NYSE:MBT) has seen an increase in hedge fund interest lately. Our calculations also showed that MBT isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a look at the fresh hedge fund action encompassing Mobile TeleSystems Public Joint Stock Company (NYSE:MBT).

What does smart money think about Mobile TeleSystems Public Joint Stock Company (NYSE:MBT)?

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from the fourth quarter of 2018. By comparison, 10 hedge funds held shares or bullish call options in MBT a year ago. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jim Simons’s Renaissance Technologies has the largest position in Mobile TeleSystems Public Joint Stock Company (NYSE:MBT), worth close to $209.1 million, comprising 0.2% of its total 13F portfolio. On Renaissance Technologies’s heels is Cliff Asness of AQR Capital Management, with a $89.1 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other peers that are bullish consist of Israel Englander’s Millennium Management, D. E. Shaw’s D E Shaw and Ken Griffin’s Citadel Investment Group.

As aggregate interest increased, some big names were leading the bulls’ herd. Ellington, managed by Mike Vranos, assembled the largest position in Mobile TeleSystems Public Joint Stock Company (NYSE:MBT). Ellington had $0.2 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also initiated a $0.1 million position during the quarter. The other funds with brand new MBT positions are Paul Tudor Jones’s Tudor Investment Corp, Steve Cohen’s Point72 Asset Management, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s go over hedge fund activity in other stocks similar to Mobile TeleSystems Public Joint Stock Company (NYSE:MBT). We will take a look at Zillow Group Inc (NASDAQ:Z), Tripadvisor Inc (NASDAQ:TRIP), Columbia Sportswear Company (NASDAQ:COLM), and Roku, Inc. (NASDAQ:ROKU). This group of stocks’ market values are closest to MBT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| Z | 33 | 623335 | 10 |

| TRIP | 27 | 1354971 | -2 |

| COLM | 32 | 359364 | 8 |

| ROKU | 33 | 505452 | 7 |

| Average | 31.25 | 710781 | 5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.25 hedge funds with bullish positions and the average amount invested in these stocks was $711 million. That figure was $322 million in MBT’s case. Zillow Group Inc (NASDAQ:Z) is the most popular stock in this table. On the other hand Tripadvisor Inc (NASDAQ:TRIP) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks Mobile TeleSystems Public Joint Stock Company (NYSE:MBT) is even less popular than TRIP. Hedge funds clearly dropped the ball on MBT as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on MBT as the stock returned 17.6% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.