Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves.

Middlesex Water Company (NASDAQ:MSEX) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 9 hedge funds’ portfolios at the end of June. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Revlon Inc (NYSE:REV), Target Hospitality Corp. (NASDAQ:TH), and Universal Insurance Holdings, Inc. (NYSEAMEX:UVE) to gather more data points. Our calculations also showed that MSEX isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the recent hedge fund action surrounding Middlesex Water Company (NASDAQ:MSEX).

How have hedgies been trading Middlesex Water Company (NASDAQ:MSEX)?

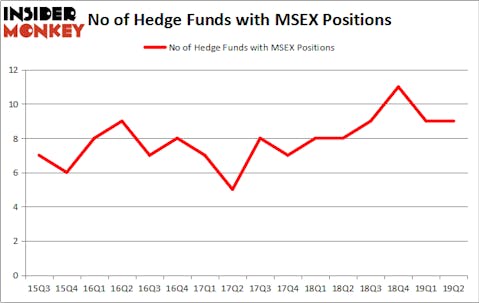

Heading into the third quarter of 2019, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MSEX over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Middlesex Water Company (NASDAQ:MSEX), with a stake worth $33.6 million reported as of the end of March. Trailing Renaissance Technologies was Impax Asset Management, which amassed a stake valued at $7.8 million. GAMCO Investors, Citadel Investment Group, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Zebra Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Citadel Investment Group).

Let’s now take a look at hedge fund activity in other stocks similar to Middlesex Water Company (NASDAQ:MSEX). These stocks are Revlon Inc (NYSE:REV), Target Hospitality Corp. (NASDAQ:TH), Universal Insurance Holdings, Inc. (NYSEAMEX:UVE), and PGT Innovations Inc. (NYSE:PGTI). This group of stocks’ market valuations resemble MSEX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| REV | 31 | 307405 | 3 |

| TH | 17 | 88582 | 0 |

| UVE | 14 | 59222 | 1 |

| PGTI | 19 | 124425 | -2 |

| Average | 20.25 | 144909 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $145 million. That figure was $49 million in MSEX’s case. Revlon Inc (NYSE:REV) is the most popular stock in this table. On the other hand Universal Insurance Holdings, Inc. (NYSEAMEX:UVE) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Middlesex Water Company (NASDAQ:MSEX) is even less popular than UVE. Hedge funds clearly dropped the ball on MSEX as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on MSEX as the stock returned 10.1% during the third quarter and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.