At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of March 31. In this article, we will use that wealth of knowledge to determine whether or not Mid America Apartment Communities Inc (NYSE:MAA) makes for a good investment right now.

Mid America Apartment Communities Inc (NYSE:MAA) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 21 hedge funds’ portfolios at the end of March. At the end of this article we will also compare MAA to other stocks including The Liberty SiriusXM Group (NASDAQ:LSXMA), The Liberty SiriusXM Group (NASDAQ:LSXMK), and Autohome Inc (NYSE:ATHM) to get a better sense of its popularity.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Paul Marshall of Marshall Wace

We’re going to view the recent hedge fund action surrounding Mid America Apartment Communities Inc (NYSE:MAA).

How are hedge funds trading Mid America Apartment Communities Inc (NYSE:MAA)?

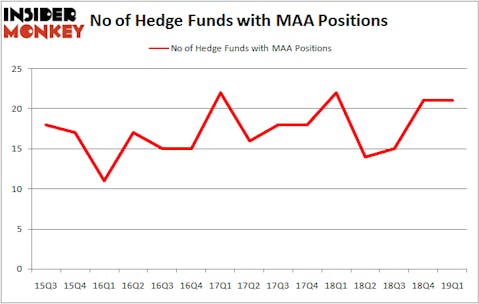

At Q1’s end, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in MAA over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Mid America Apartment Communities Inc (NYSE:MAA), which was worth $162.6 million at the end of the first quarter. On the second spot was Diamond Hill Capital which amassed $67.1 million worth of shares. Moreover, Fisher Asset Management, Millennium Management, and Adage Capital Management were also bullish on Mid America Apartment Communities Inc (NYSE:MAA), allocating a large percentage of their portfolios to this stock.

Seeing as Mid America Apartment Communities Inc (NYSE:MAA) has faced bearish sentiment from hedge fund managers, it’s safe to say that there was a specific group of money managers that elected to cut their entire stakes heading into Q3. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the largest investment of the 700 funds watched by Insider Monkey, worth an estimated $2.6 million in stock, and D. E. Shaw’s D E Shaw was right behind this move, as the fund dumped about $0.9 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Mid America Apartment Communities Inc (NYSE:MAA) but similarly valued. These stocks are The Liberty SiriusXM Group (NASDAQ:LSXMA), The Liberty SiriusXM Group (NASDAQ:LSXMK), Autohome Inc (NYSE:ATHM), and Huazhu Group Limited (NASDAQ:HTHT). This group of stocks’ market valuations resemble MAA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LSXMA | 41 | 1344969 | 2 |

| LSXMK | 45 | 2653274 | 0 |

| ATHM | 16 | 1251641 | 2 |

| HTHT | 14 | 196127 | -1 |

| Average | 29 | 1361503 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1362 million. That figure was $356 million in MAA’s case. The Liberty SiriusXM Group (NASDAQ:LSXMK) is the most popular stock in this table. On the other hand Huazhu Group Limited (NASDAQ:HTHT) is the least popular one with only 14 bullish hedge fund positions. Mid America Apartment Communities Inc (NYSE:MAA) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on MAA as the stock returned 4.6% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.