With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the first quarter. One of these stocks was Mettler-Toledo International Inc. (NYSE:MTD).

Mettler-Toledo International Inc. (NYSE:MTD) investors should pay attention to a decrease in enthusiasm from smart money of late. MTD was in 18 hedge funds’ portfolios at the end of the first quarter of 2019. There were 22 hedge funds in our database with MTD positions at the end of the previous quarter. Our calculations also showed that mtd isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a lot of metrics stock market investors have at their disposal to size up their holdings. Some of the less known metrics are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the best hedge fund managers can outpace the broader indices by a healthy margin (see the details here).

We’re going to go over the key hedge fund action surrounding Mettler-Toledo International Inc. (NYSE:MTD).

What does the smart money think about Mettler-Toledo International Inc. (NYSE:MTD)?

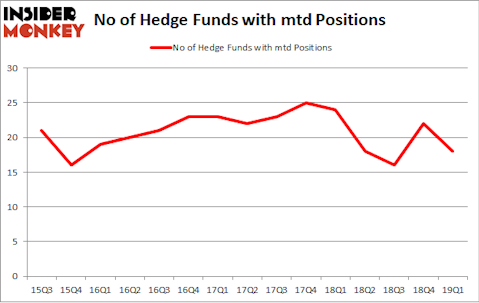

Heading into the second quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of -18% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in MTD over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Cliff Asness’s AQR Capital Management has the biggest position in Mettler-Toledo International Inc. (NYSE:MTD), worth close to $83.3 million, accounting for 0.1% of its total 13F portfolio. The second largest stake is held by GLG Partners, led by Noam Gottesman, holding a $35.7 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism consist of Peter Muller’s PDT Partners, David Harding’s Winton Capital Management and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Because Mettler-Toledo International Inc. (NYSE:MTD) has witnessed bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of hedgies who were dropping their full holdings by the end of the third quarter. At the top of the heap, Richard Chilton’s Chilton Investment Company dumped the largest investment of all the hedgies tracked by Insider Monkey, worth an estimated $27.6 million in stock. Robert Joseph Caruso’s fund, Select Equity Group, also sold off its stock, about $23.1 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 4 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Mettler-Toledo International Inc. (NYSE:MTD). These stocks are The Hartford Financial Services Group, Inc. (NYSE:HIG), Cadence Design Systems Inc (NASDAQ:CDNS), Plains All American Pipeline, L.P. (NYSE:PAA), and Nucor Corporation (NYSE:NUE). This group of stocks’ market caps are similar to MTD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HIG | 37 | 1332799 | 7 |

| CDNS | 31 | 1644853 | 2 |

| PAA | 8 | 96116 | 0 |

| NUE | 26 | 319449 | 0 |

| Average | 25.5 | 848304 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $848 million. That figure was $222 million in MTD’s case. The Hartford Financial Services Group, Inc. (NYSE:HIG) is the most popular stock in this table. On the other hand Plains All American Pipeline, L.P. (NYSE:PAA) is the least popular one with only 8 bullish hedge fund positions. Mettler-Toledo International Inc. (NYSE:MTD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on MTD, though not to the same extent, as the stock returned 0.6% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.