Is Loews Corporation (NYSE:L) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

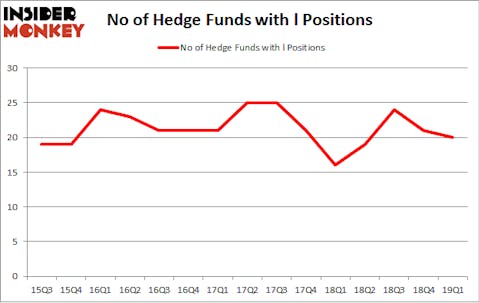

Is Loews Corporation (NYSE:L) a healthy stock for your portfolio? Hedge funds are reducing their bets on the stock. The number of long hedge fund bets decreased by 1 in recent months. Our calculations also showed that l isn’t among the 30 most popular stocks among hedge funds.

To most investors, hedge funds are seen as worthless, old financial vehicles of years past. While there are over 8000 funds in operation at the moment, We choose to focus on the elite of this club, around 750 funds. These hedge fund managers direct the lion’s share of the hedge fund industry’s total capital, and by following their inimitable investments, Insider Monkey has deciphered many investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s view the new hedge fund action surrounding Loews Corporation (NYSE:L).

How have hedgies been trading Loews Corporation (NYSE:L)?

Heading into the second quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from the previous quarter. By comparison, 16 hedge funds held shares or bullish call options in L a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Diamond Hill Capital held the most valuable stake in Loews Corporation (NYSE:L), which was worth $165.5 million at the end of the first quarter. On the second spot was Wallace Capital Management which amassed $20.4 million worth of shares. Moreover, Renaissance Technologies, Levin Capital Strategies, and AQR Capital Management were also bullish on Loews Corporation (NYSE:L), allocating a large percentage of their portfolios to this stock.

Because Loews Corporation (NYSE:L) has experienced a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there was a specific group of funds who sold off their full holdings by the end of the third quarter. Intriguingly, D. E. Shaw’s D E Shaw dumped the biggest position of the 700 funds followed by Insider Monkey, valued at about $7.4 million in stock. Israel Englander’s fund, Millennium Management, also dumped its stock, about $4 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to Loews Corporation (NYSE:L). We will take a look at Canopy Growth Corporation (NYSE:CGC), ResMed Inc. (NYSE:RMD), DISH Network Corp. (NASDAQ:DISH), and Altice USA, Inc. (NYSE:ATUS). All of these stocks’ market caps resemble L’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CGC | 6 | 72973 | 1 |

| RMD | 18 | 147376 | -4 |

| DISH | 27 | 1305780 | -10 |

| ATUS | 52 | 2522218 | 1 |

| Average | 25.75 | 1012087 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $1012 million. That figure was $236 million in L’s case. Altice USA, Inc. (NYSE:ATUS) is the most popular stock in this table. On the other hand Canopy Growth Corporation (NYSE:CGC) is the least popular one with only 6 bullish hedge fund positions. Loews Corporation (NYSE:L) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on L as the stock returned 7.2% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.