It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of 6 percentage points during the first 5 months of 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in ITT Inc. (NYSE:ITT).

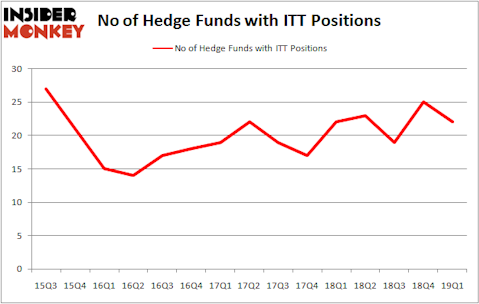

ITT Inc. (NYSE:ITT) investors should pay attention to a decrease in enthusiasm from smart money lately. ITT was in 22 hedge funds’ portfolios at the end of March. There were 25 hedge funds in our database with ITT positions at the end of the previous quarter. Our calculations also showed that ITT isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most shareholders, hedge funds are assumed to be unimportant, outdated financial vehicles of yesteryear. While there are more than 8000 funds trading at present, We hone in on the leaders of this group, about 750 funds. These money managers direct bulk of all hedge funds’ total capital, and by tailing their unrivaled picks, Insider Monkey has determined a few investment strategies that have historically beaten the market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to view the latest hedge fund action regarding ITT Inc. (NYSE:ITT).

What does the smart money think about ITT Inc. (NYSE:ITT)?

At the end of the first quarter, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -12% from one quarter earlier. On the other hand, there were a total of 22 hedge funds with a bullish position in ITT a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in ITT Inc. (NYSE:ITT) was held by Adage Capital Management, which reported holding $136.1 million worth of stock at the end of March. It was followed by AQR Capital Management with a $81.7 million position. Other investors bullish on the company included Scopus Asset Management, GAMCO Investors, and Arrowstreet Capital.

Because ITT Inc. (NYSE:ITT) has faced declining sentiment from the aggregate hedge fund industry, we can see that there lies a certain “tier” of funds that decided to sell off their positions entirely in the third quarter. Interestingly, Clint Carlson’s Carlson Capital dropped the largest position of the 700 funds followed by Insider Monkey, totaling an estimated $16.2 million in call options. Alexander Mitchell’s fund, Scopus Asset Management, also dropped its call options, about $4.8 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 3 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to ITT Inc. (NYSE:ITT). We will take a look at Crane Co. (NYSE:CR), Insperity Inc (NYSE:NSP), Bemis Company, Inc. (NYSE:BMS), and Chesapeake Energy Corporation (NYSE:CHK). This group of stocks’ market caps match ITT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CR | 22 | 334024 | -1 |

| NSP | 24 | 458494 | 0 |

| BMS | 29 | 373125 | 3 |

| CHK | 20 | 179653 | 5 |

| Average | 23.75 | 336324 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $336 million. That figure was $395 million in ITT’s case. Bemis Company, Inc. (NYSE:BMS) is the most popular stock in this table. On the other hand Chesapeake Energy Corporation (NYSE:CHK) is the least popular one with only 20 bullish hedge fund positions. ITT Inc. (NYSE:ITT) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on ITT, though not to the same extent, as the stock returned 1.1% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.