Before we spend days researching a stock idea we like to take a look at how hedge funds and billionaire investors recently traded that stock. The S&P 500 Index ETF (SPY) lost 2.6% in the first two months of the second quarter. Ten out of 11 industry groups in the S&P 500 Index lost value in May. The average return of a randomly picked stock in the index was even worse (-3.6%). This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 20 most popular S&P 500 stocks among hedge funds not only generated positive returns but also outperformed the index by about 3 percentage points through May 30th. In this article, we will take a look at what hedge funds think about IDEX Corporation (NYSE:IEX).

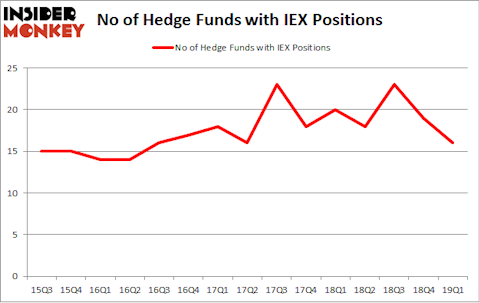

IDEX Corporation (NYSE:IEX) was in 16 hedge funds’ portfolios at the end of the first quarter of 2019. IEX shareholders have witnessed a decrease in support from the world’s most elite money managers in recent months. There were 19 hedge funds in our database with IEX holdings at the end of the previous quarter. Our calculations also showed that iex isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are tons of gauges market participants use to grade publicly traded companies. Two of the most underrated gauges are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the elite investment managers can outclass the S&P 500 by a significant margin (see the details here).

Matthew Hulsizer of PEAK6 Capital

We’re going to check out the fresh hedge fund action surrounding IDEX Corporation (NYSE:IEX).

Hedge fund activity in IDEX Corporation (NYSE:IEX)

At the end of the first quarter, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of -16% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in IEX over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in IDEX Corporation (NYSE:IEX) was held by Impax Asset Management, which reported holding $204.5 million worth of stock at the end of March. It was followed by GAMCO Investors with a $67 million position. Other investors bullish on the company included AQR Capital Management, Millennium Management, and PEAK6 Capital Management.

Seeing as IDEX Corporation (NYSE:IEX) has experienced falling interest from the smart money, it’s easy to see that there lies a certain “tier” of funds that decided to sell off their positions entirely in the third quarter. Intriguingly, Dmitry Balyasny’s Balyasny Asset Management said goodbye to the largest position of the “upper crust” of funds tracked by Insider Monkey, worth close to $2.4 million in stock, and Anand Parekh’s Alyeska Investment Group was right behind this move, as the fund cut about $1.5 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 3 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to IDEX Corporation (NYSE:IEX). We will take a look at Campbell Soup Company (NYSE:CPB), Apollo Global Management LLC (NYSE:APO), StoneCo Ltd. (NASDAQ:STNE), and E*TRADE Financial Corporation (NASDAQ:ETFC). This group of stocks’ market caps resemble IEX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CPB | 28 | 1032966 | -1 |

| APO | 18 | 1406351 | -4 |

| STNE | 23 | 1735395 | 3 |

| ETFC | 43 | 1473468 | 2 |

| Average | 28 | 1412045 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $1412 million. That figure was $321 million in IEX’s case. E*TRADE Financial Corporation (NASDAQ:ETFC) is the most popular stock in this table. On the other hand Apollo Global Management LLC (NYSE:APO) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks IDEX Corporation (NYSE:IEX) is even less popular than APO. Hedge funds clearly dropped the ball on IEX as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on IEX as the stock returned 8.5% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.