Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 20 stock picks easily bested the broader market, at 18.7% compared to 12.1%, despite there being a few duds in there like Berkshire Hathaway (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

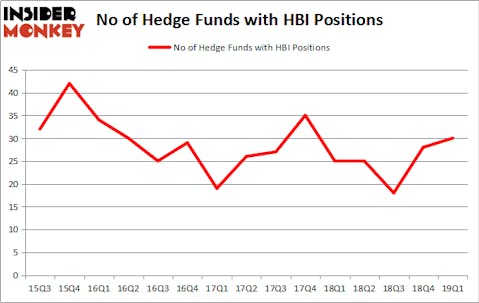

Hanesbrands Inc. (NYSE:HBI) investors should pay attention to an increase in activity from the world’s largest hedge funds recently. HBI was in 30 hedge funds’ portfolios at the end of the first quarter of 2019. There were 28 hedge funds in our database with HBI holdings at the end of the previous quarter. Our calculations also showed that HBI isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are a large number of gauges shareholders use to grade their stock investments. A duo of the most innovative gauges are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top investment managers can outperform the market by a superb amount (see the details here).

We’re going to view the recent hedge fund action surrounding Hanesbrands Inc. (NYSE:HBI).

What does the smart money think about Hanesbrands Inc. (NYSE:HBI)?

At Q1’s end, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the fourth quarter of 2018. On the other hand, there were a total of 25 hedge funds with a bullish position in HBI a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

The largest stake in Hanesbrands Inc. (NYSE:HBI) was held by Diamond Hill Capital, which reported holding $200.1 million worth of stock at the end of March. It was followed by D E Shaw with a $76.7 million position. Other investors bullish on the company included Interval Partners, Arrowstreet Capital, and Citadel Investment Group.

As aggregate interest increased, specific money managers were breaking ground themselves. D E Shaw, managed by D. E. Shaw, created the biggest position in Hanesbrands Inc. (NYSE:HBI). D E Shaw had $76.7 million invested in the company at the end of the quarter. Gregg Moskowitz’s Interval Partners also initiated a $39.2 million position during the quarter. The other funds with brand new HBI positions are Jim Simons’s Renaissance Technologies, Anthony Joseph Vaccarino’s North Fourth Asset Management, and Jeffrey Talpins’s Element Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Hanesbrands Inc. (NYSE:HBI). We will take a look at Dolby Laboratories, Inc. (NYSE:DLB), Telecom Argentina S.A. (NYSE:TEO), Mellanox Technologies, Ltd. (NASDAQ:MLNX), and FLIR Systems, Inc. (NASDAQ:FLIR). This group of stocks’ market caps resemble HBI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DLB | 29 | 535572 | 6 |

| TEO | 9 | 89696 | 0 |

| MLNX | 41 | 1454898 | -4 |

| FLIR | 32 | 537175 | 8 |

| Average | 27.75 | 654335 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.75 hedge funds with bullish positions and the average amount invested in these stocks was $654 million. That figure was $524 million in HBI’s case. Mellanox Technologies, Ltd. (NASDAQ:MLNX) is the most popular stock in this table. On the other hand Telecom Argentina S.A. (NYSE:TEO) is the least popular one with only 9 bullish hedge fund positions. Hanesbrands Inc. (NYSE:HBI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately HBI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on HBI were disappointed as the stock returned -14.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.