Is Gibraltar Industries Inc (NASDAQ:ROCK) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

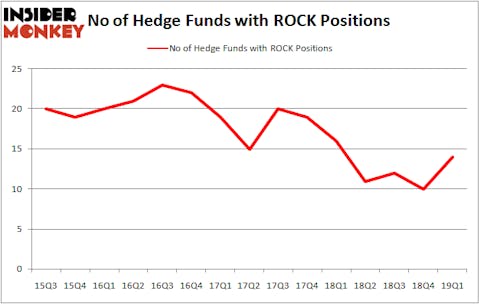

Is Gibraltar Industries Inc (NASDAQ:ROCK) a bargain? The best stock pickers are taking an optimistic view. The number of bullish hedge fund positions rose by 4 lately. Our calculations also showed that ROCK isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are tons of gauges stock market investors can use to grade their stock investments. A duo of the most under-the-radar gauges are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the best fund managers can outclass their index-focused peers by a healthy amount (see the details here).

Let’s take a gander at the latest hedge fund action encompassing Gibraltar Industries Inc (NASDAQ:ROCK).

Hedge fund activity in Gibraltar Industries Inc (NASDAQ:ROCK)

Heading into the second quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 40% from one quarter earlier. By comparison, 16 hedge funds held shares or bullish call options in ROCK a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Among these funds, Pzena Investment Management held the most valuable stake in Gibraltar Industries Inc (NASDAQ:ROCK), which was worth $43.2 million at the end of the first quarter. On the second spot was Headlands Capital which amassed $17.6 million worth of shares. Moreover, Royce & Associates, Renaissance Technologies, and D E Shaw were also bullish on Gibraltar Industries Inc (NASDAQ:ROCK), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Magnetar Capital, managed by Alec Litowitz and Ross Laser, initiated the most valuable position in Gibraltar Industries Inc (NASDAQ:ROCK). Magnetar Capital had $0.6 million invested in the company at the end of the quarter. Guy Shahar’s DSAM Partners also initiated a $0.4 million position during the quarter. The other funds with brand new ROCK positions are Jeffrey Talpins’s Element Capital Management and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Gibraltar Industries Inc (NASDAQ:ROCK). These stocks are Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA), Atlas Air Worldwide Holdings, Inc. (NASDAQ:AAWW), Realogy Holdings Corp (NYSE:RLGY), and Avon Products, Inc. (NYSE:AVP). This group of stocks’ market caps resemble ROCK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LOMA | 7 | 17313 | 0 |

| AAWW | 19 | 126287 | 0 |

| RLGY | 28 | 441695 | 8 |

| AVP | 22 | 260384 | -2 |

| Average | 19 | 211420 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $211 million. That figure was $97 million in ROCK’s case. Realogy Holdings Corp (NYSE:RLGY) is the most popular stock in this table. On the other hand Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA) is the least popular one with only 7 bullish hedge fund positions. Gibraltar Industries Inc (NASDAQ:ROCK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately ROCK wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); ROCK investors were disappointed as the stock returned -3.2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.