While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and optimism towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the first quarter and hedging or reducing many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Garmin Ltd. (NASDAQ:GRMN).

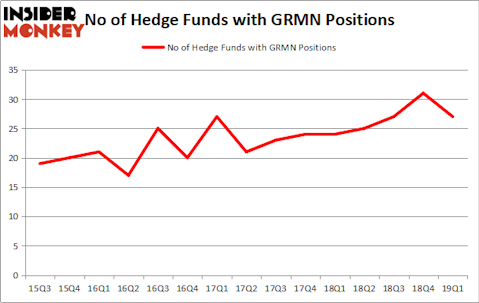

Is Garmin Ltd. (NASDAQ:GRMN) the right investment to pursue these days? The best stock pickers are in a pessimistic mood. The number of bullish hedge fund bets fell by 4 in recent months. Our calculations also showed that GRMN isn’t among the 30 most popular stocks among hedge funds. GRMN was in 27 hedge funds’ portfolios at the end of March. There were 31 hedge funds in our database with GRMN holdings at the end of the previous quarter.

In today’s marketplace there are several metrics stock traders put to use to value stocks. A couple of the less known metrics are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the elite money managers can outperform the market by a very impressive amount (see the details here).

We’re going to analyze the latest hedge fund action surrounding Garmin Ltd. (NASDAQ:GRMN).

How have hedgies been trading Garmin Ltd. (NASDAQ:GRMN)?

Heading into the second quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -13% from one quarter earlier. By comparison, 24 hedge funds held shares or bullish call options in GRMN a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, D E Shaw was the largest shareholder of Garmin Ltd. (NASDAQ:GRMN), with a stake worth $124.9 million reported as of the end of March. Trailing D E Shaw was Select Equity Group, which amassed a stake valued at $99.3 million. AQR Capital Management, Renaissance Technologies, and Arrowstreet Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Garmin Ltd. (NASDAQ:GRMN) has faced a decline in interest from hedge fund managers, we can see that there lies a certain “tier” of money managers that elected to cut their full holdings heading into Q3. Interestingly, James Woodson Davis’s Woodson Capital Management dropped the biggest stake of the 700 funds tracked by Insider Monkey, totaling an estimated $4.2 million in stock, and Daniel Arbess’s Perella Weinberg Partners was right behind this move, as the fund dumped about $4 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 4 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Garmin Ltd. (NASDAQ:GRMN) but similarly valued. These stocks are Genuine Parts Company (NYSE:GPC), Omnicom Group Inc. (NYSE:OMC), Alexandria Real Estate Equities Inc (NYSE:ARE), and SS&C Technologies Holdings, Inc. (NASDAQ:SSNC). This group of stocks’ market valuations are closest to GRMN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GPC | 22 | 326495 | -7 |

| OMC | 20 | 661219 | 2 |

| ARE | 17 | 207362 | -5 |

| SSNC | 37 | 1718479 | 0 |

| Average | 24 | 728389 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $728 million. That figure was $513 million in GRMN’s case. SS&C Technologies Holdings, Inc. (NASDAQ:SSNC) is the most popular stock in this table. On the other hand Alexandria Real Estate Equities Inc (NYSE:ARE) is the least popular one with only 17 bullish hedge fund positions. Garmin Ltd. (NASDAQ:GRMN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately GRMN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on GRMN were disappointed as the stock returned -10.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.