Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Flushing Financial Corporation (NASDAQ:FFIC).

Is Flushing Financial Corporation (NASDAQ:FFIC) ready to rally soon? The smart money is reducing their bets on the stock. The number of long hedge fund bets shrunk by 1 recently. Our calculations also showed that ffic isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are assumed to be underperforming, outdated investment vehicles of years past. While there are more than 8000 funds in operation at the moment, Our experts choose to focus on the moguls of this group, approximately 750 funds. Most estimates calculate that this group of people have their hands on the lion’s share of all hedge funds’ total asset base, and by keeping an eye on their best investments, Insider Monkey has determined many investment strategies that have historically outpaced the market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a look at the key hedge fund action surrounding Flushing Financial Corporation (NASDAQ:FFIC).

How have hedgies been trading Flushing Financial Corporation (NASDAQ:FFIC)?

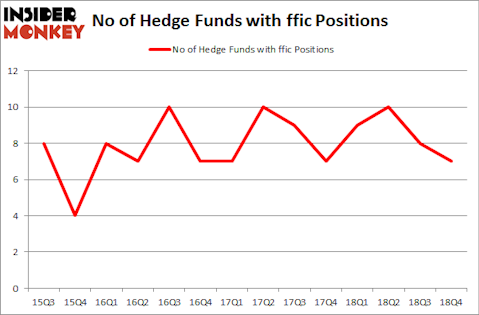

Heading into the first quarter of 2019, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from the previous quarter. The graph below displays the number of hedge funds with bullish position in FFIC over the last 14 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in Flushing Financial Corporation (NASDAQ:FFIC) was held by GAMCO Investors, which reported holding $23.3 million worth of stock at the end of December. It was followed by Renaissance Technologies with a $10.8 million position. Other investors bullish on the company included AlphaOne Capital Partners, D E Shaw, and AQR Capital Management.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Citadel Investment Group. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 700+ hedge funds tracked by Insider Monkey identified FFIC as a viable investment and initiated a position in the stock.

Let’s also examine hedge fund activity in other stocks similar to Flushing Financial Corporation (NASDAQ:FFIC). We will take a look at Lantheus Holdings Inc (NASDAQ:LNTH), Scholar Rock Holding Corporation (NASDAQ:SRRK), Eagle Pharmaceuticals Inc (NASDAQ:EGRX), and Adaptimmune Therapeutics plc (NASDAQ:ADAP). All of these stocks’ market caps resemble FFIC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LNTH | 17 | 65005 | 1 |

| SRRK | 4 | 80044 | 0 |

| EGRX | 21 | 143787 | 2 |

| ADAP | 12 | 196466 | -1 |

| Average | 13.5 | 121326 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $121 million. That figure was $41 million in FFIC’s case. Eagle Pharmaceuticals Inc (NASDAQ:EGRX) is the most popular stock in this table. On the other hand Scholar Rock Holding Corporation (NASDAQ:SRRK) is the least popular one with only 4 bullish hedge fund positions. Flushing Financial Corporation (NASDAQ:FFIC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FFIC wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); FFIC investors were disappointed as the stock returned 5.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.