Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards First Busey Corporation (NASDAQ:BUSE).

Is First Busey Corporation (NASDAQ:BUSE) worth your attention right now? Prominent investors are becoming hopeful. The number of bullish hedge fund positions advanced by 1 lately. Our calculations also showed that BUSE isn’t among the 30 most popular stocks among hedge funds. BUSE was in 13 hedge funds’ portfolios at the end of March. There were 12 hedge funds in our database with BUSE holdings at the end of the previous quarter.

According to most market participants, hedge funds are assumed to be worthless, old financial vehicles of yesteryear. While there are over 8000 funds trading today, Our experts look at the upper echelon of this club, around 750 funds. These investment experts have their hands on bulk of all hedge funds’ total capital, and by tailing their finest investments, Insider Monkey has uncovered numerous investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a glance at the fresh hedge fund action regarding First Busey Corporation (NASDAQ:BUSE).

Hedge fund activity in First Busey Corporation (NASDAQ:BUSE)

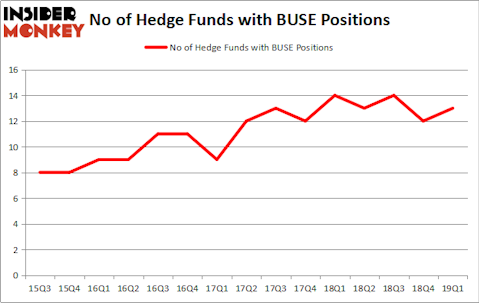

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in BUSE over the last 15 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jim Simons’s Renaissance Technologies has the biggest position in First Busey Corporation (NASDAQ:BUSE), worth close to $23.4 million, comprising less than 0.1%% of its total 13F portfolio. Coming in second is Basswood Capital, led by Matthew Lindenbaum, holding a $2.9 million position; 0.2% of its 13F portfolio is allocated to the company. Other members of the smart money that are bullish include D. E. Shaw’s D E Shaw, Israel Englander’s Millennium Management and Cliff Asness’s AQR Capital Management.

As one would reasonably expect, specific money managers have been driving this bullishness. ExodusPoint Capital, managed by Michael Gelband, initiated the most outsized position in First Busey Corporation (NASDAQ:BUSE). ExodusPoint Capital had $0.5 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also made a $0.3 million investment in the stock during the quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as First Busey Corporation (NASDAQ:BUSE) but similarly valued. We will take a look at SPX FLOW, Inc. (NYSE:FLOW), NovaGold Resources Inc. (NYSEAMEX:NG), Asbury Automotive Group, Inc. (NYSE:ABG), and Seacoast Banking Corporation of Florida (NASDAQ:SBCF). This group of stocks’ market caps resemble BUSE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FLOW | 20 | 154898 | 0 |

| NG | 13 | 168145 | -6 |

| ABG | 15 | 193748 | -1 |

| SBCF | 8 | 44815 | 2 |

| Average | 14 | 140402 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $140 million. That figure was $35 million in BUSE’s case. SPX FLOW, Inc. (NYSE:FLOW) is the most popular stock in this table. On the other hand Seacoast Banking Corporation of Florida (NASDAQ:SBCF) is the least popular one with only 8 bullish hedge fund positions. First Busey Corporation (NASDAQ:BUSE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on BUSE as the stock returned 7.3% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.