Is EZCORP Inc (NASDAQ:EZPW) a good stock to buy according to hedge funds? Hedge fund interest in EZPW shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare EZPW to other stocks including Transenterix Inc (NYSEMKT:TRXC), pdvWireless Inc (NASDAQ:PDVW), and McEwen Mining Inc (NYSE:MUX) to get a better sense of its popularity.

In the 21st century investor’s toolkit there are a large number of methods stock market investors employ to evaluate stocks. A pair of the most underrated methods are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the best picks of the best money managers can trounce the S&P 500 by a significant amount (see the details here).

Let’s take a look at the new hedge fund action encompassing EZCORP Inc (NASDAQ:EZPW).

Hedge fund activity in EZCORP Inc (NASDAQ:EZPW)

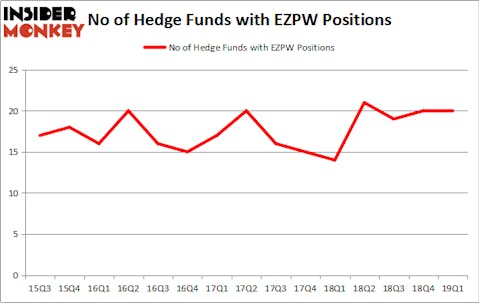

At Q1’s end, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2018. By comparison, 14 hedge funds held shares or bullish call options in EZPW a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Lafitte Capital Management was the largest shareholder of EZCORP Inc (NASDAQ:EZPW), with a stake worth $50.3 million reported as of the end of March. Trailing Lafitte Capital Management was Archon Capital Management, which amassed a stake valued at $11.6 million. Renaissance Technologies, Sabrepoint Capital, and Azora Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that EZCORP Inc (NASDAQ:EZPW) has faced falling interest from hedge fund managers, logic holds that there is a sect of money managers that decided to sell off their full holdings last quarter. At the top of the heap, Amy Minella’s Cardinal Capital sold off the biggest investment of all the hedgies monitored by Insider Monkey, totaling about $7.5 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund dropped about $2.9 million worth. These moves are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to EZCORP Inc (NASDAQ:EZPW). We will take a look at Transenterix Inc (NYSEMKT:TRXC), pdvWireless Inc (NASDAQ:PDVW), McEwen Mining Inc (NYSE:MUX), and U.S. Well Services, Inc. (NASDAQ:USWS). This group of stocks’ market valuations resemble EZPW’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRXC | 13 | 10958 | 5 |

| PDVW | 13 | 252859 | 1 |

| MUX | 5 | 4852 | 0 |

| USWS | 13 | 42384 | -1 |

| Average | 11 | 77763 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $78 million. That figure was $117 million in EZPW’s case. Transenterix Inc (NYSEMKT:TRXC) is the most popular stock in this table. On the other hand McEwen Mining Inc (NYSE:MUX) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks EZCORP Inc (NASDAQ:EZPW) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately EZPW wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on EZPW were disappointed as the stock returned -2.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.