Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 2.6% in the first two months of the second quarter. Ten out of 11 industry groups in the S&P 500 Index lost value in May. The average return of a randomly picked stock in the index was even worse (-3.6%). This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 20 most popular S&P 500 stocks among hedge funds not only generated positive returns but also outperformed the index by about 3 percentage points through May 30th. In this article, we will take a look at what hedge funds think about E*TRADE Financial Corporation (NASDAQ:ETFC).

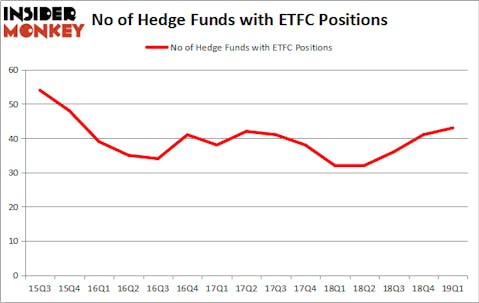

Is E*TRADE Financial Corporation (NASDAQ:ETFC) worth your attention right now? Hedge funds are becoming hopeful. The number of bullish hedge fund positions increased by 2 lately. Our calculations also showed that ETFC isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to view the fresh hedge fund action regarding E*TRADE Financial Corporation (NASDAQ:ETFC).

What have hedge funds been doing with E*TRADE Financial Corporation (NASDAQ:ETFC)?

Heading into the second quarter of 2019, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from the fourth quarter of 2018. On the other hand, there were a total of 32 hedge funds with a bullish position in ETFC a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

The largest stake in E*TRADE Financial Corporation (NASDAQ:ETFC) was held by D E Shaw, which reported holding $175.2 million worth of stock at the end of March. It was followed by Millennium Management with a $153.6 million position. Other investors bullish on the company included Point72 Asset Management, Citadel Investment Group, and Arrowstreet Capital.

With a general bullishness amongst the heavyweights, key money managers were leading the bulls’ herd. Point72 Asset Management, managed by Steve Cohen, established the largest position in E*TRADE Financial Corporation (NASDAQ:ETFC). Point72 Asset Management had $127.6 million invested in the company at the end of the quarter. Doug Silverman and Alexander Klabin’s Senator Investment Group also made a $74.3 million investment in the stock during the quarter. The other funds with new positions in the stock are David Costen Haley’s HBK Investments, Peter Seuss’s Prana Capital Management, and Matthew Tewksbury’s Stevens Capital Management.

Let’s go over hedge fund activity in other stocks similar to E*TRADE Financial Corporation (NASDAQ:ETFC). These stocks are Raymond James Financial, Inc. (NYSE:RJF), Regency Centers Corp (NASDAQ:REG), Zebra Technologies Corporation (NASDAQ:ZBRA), and Ionis Pharmaceuticals, Inc. (NASDAQ:IONS). This group of stocks’ market values are similar to ETFC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RJF | 35 | 794772 | 10 |

| REG | 17 | 397323 | 2 |

| ZBRA | 35 | 1101221 | 6 |

| IONS | 22 | 236032 | 1 |

| Average | 27.25 | 632337 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.25 hedge funds with bullish positions and the average amount invested in these stocks was $632 million. That figure was $1473 million in ETFC’s case. Raymond James Financial, Inc. (NYSE:RJF) is the most popular stock in this table. On the other hand Regency Centers Corp (NASDAQ:REG) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks E*TRADE Financial Corporation (NASDAQ:ETFC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on ETFC, though not to the same extent, as the stock returned -0.8% during the same period and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.