Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 5 months of this year through May 30th the Standard and Poor’s 500 Index returned approximately 12.1% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like East West Bancorp, Inc. (NASDAQ:EWBC).

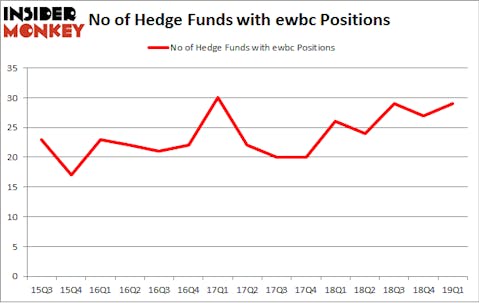

East West Bancorp, Inc. (NASDAQ:EWBC) has seen an increase in enthusiasm from smart money lately. Our calculations also showed that ewbc isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are several metrics stock market investors have at their disposal to appraise their holdings. A duo of the most underrated metrics are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can outclass their index-focused peers by a very impressive margin (see the details here).

We’re going to take a glance at the recent hedge fund action surrounding East West Bancorp, Inc. (NASDAQ:EWBC).

What does the smart money think about East West Bancorp, Inc. (NASDAQ:EWBC)?

Heading into the second quarter of 2019, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from one quarter earlier. On the other hand, there were a total of 26 hedge funds with a bullish position in EWBC a year ago. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ken Fisher’s Fisher Asset Management has the number one position in East West Bancorp, Inc. (NASDAQ:EWBC), worth close to $93.8 million, amounting to 0.1% of its total 13F portfolio. On Fisher Asset Management’s heels is D E Shaw, managed by D. E. Shaw, which holds a $56.9 million position; 0.1% of its 13F portfolio is allocated to the company. Other peers that hold long positions include John Overdeck and David Siegel’s Two Sigma Advisors, Phill Gross and Robert Atchinson’s Adage Capital Management and Ken Griffin’s Citadel Investment Group.

As one would reasonably expect, key hedge funds have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, assembled the most outsized position in East West Bancorp, Inc. (NASDAQ:EWBC). Point72 Asset Management had $1 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also made a $0.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Joel Greenblatt’s Gotham Asset Management, Thomas Bailard’s Bailard Inc, and Bruce Kovner’s Caxton Associates LP.

Let’s also examine hedge fund activity in other stocks similar to East West Bancorp, Inc. (NASDAQ:EWBC). These stocks are Cemex SAB de CV (NYSE:CX), Qurate Retail, Inc. (NASDAQ:QRTEA), Five Below Inc (NASDAQ:FIVE), and Teradyne, Inc. (NASDAQ:TER). This group of stocks’ market caps are closest to EWBC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CX | 15 | 90996 | 5 |

| QRTEA | 33 | 725955 | -2 |

| FIVE | 38 | 487778 | 6 |

| TER | 24 | 564379 | -1 |

| Average | 27.5 | 467277 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.5 hedge funds with bullish positions and the average amount invested in these stocks was $467 million. That figure was $438 million in EWBC’s case. Five Below Inc (NASDAQ:FIVE) is the most popular stock in this table. On the other hand Cemex SAB de CV (NYSE:CX) is the least popular one with only 15 bullish hedge fund positions. East West Bancorp, Inc. (NASDAQ:EWBC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately EWBC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on EWBC were disappointed as the stock returned -8.1% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.