We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article we look at what those investors think of Stantec Inc. (NYSE:STN).

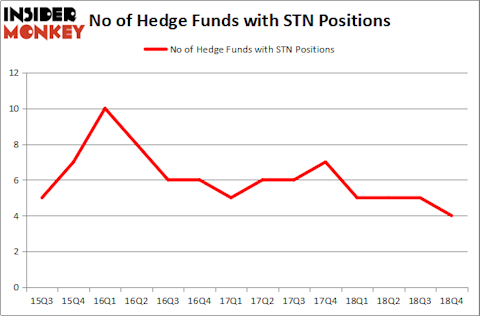

Stantec Inc. (NYSE:STN) was in 4 hedge funds’ portfolios at the end of December. STN has experienced a decrease in enthusiasm from smart money in recent months. There were 5 hedge funds in our database with STN holdings at the end of the previous quarter. Our calculations also showed that STN isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s check out the key hedge fund action encompassing Stantec Inc. (NYSE:STN).

How are hedge funds trading Stantec Inc. (NYSE:STN)?

At Q4’s end, a total of 4 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -20% from the previous quarter. The graph below displays the number of hedge funds with bullish position in STN over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Stantec Inc. (NYSE:STN) was held by Luminus Management, which reported holding $55.7 million worth of stock at the end of December. It was followed by Renaissance Technologies with a $2.4 million position. Other investors bullish on the company included D E Shaw and GLG Partners.

Since Stantec Inc. (NYSE:STN) has experienced bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there exists a select few fund managers who were dropping their positions entirely heading into Q3. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dropped the largest position of the “upper crust” of funds watched by Insider Monkey, worth an estimated $13.9 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund dropped about $0.2 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest fell by 1 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to Stantec Inc. (NYSE:STN). We will take a look at American States Water Co (NYSE:AWR), Strategic Education, Inc. (NASDAQ:STRA), Simpson Manufacturing Co, Inc. (NYSE:SSD), and Valmont Industries, Inc. (NYSE:VMI). This group of stocks’ market caps are closest to STN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AWR | 12 | 67657 | 0 |

| STRA | 12 | 220516 | -3 |

| SSD | 17 | 189870 | 0 |

| VMI | 18 | 203426 | 1 |

| Average | 14.75 | 170367 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $170 million. That figure was $61 million in STN’s case. Valmont Industries, Inc. (NYSE:VMI) is the most popular stock in this table. On the other hand American States Water Co (NYSE:AWR) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Stantec Inc. (NYSE:STN) is even less popular than AWR. Hedge funds dodged a bullet by taking a bearish stance towards STN. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately STN wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); STN investors were disappointed as the stock returned 14.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.