At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

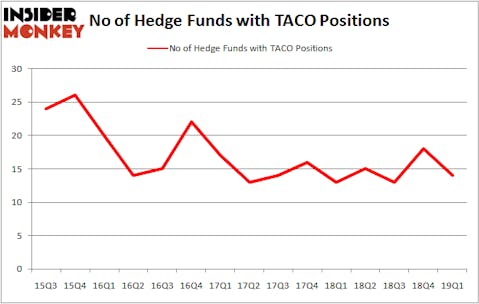

Del Taco Restaurants Inc (NASDAQ:TACO) was in 14 hedge funds’ portfolios at the end of March. TACO investors should be aware of a decrease in hedge fund interest recently. There were 18 hedge funds in our database with TACO positions at the end of the previous quarter. Our calculations also showed that TACO isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are assumed to be slow, old financial vehicles of the past. While there are over 8000 funds with their doors open at the moment, Our researchers look at the moguls of this club, around 750 funds. Most estimates calculate that this group of people shepherd bulk of the smart money’s total capital, and by keeping track of their matchless stock picks, Insider Monkey has identified a number of investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s check out the key hedge fund action encompassing Del Taco Restaurants Inc (NASDAQ:TACO).

Hedge fund activity in Del Taco Restaurants Inc (NASDAQ:TACO)

At the end of the first quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -22% from the fourth quarter of 2018. By comparison, 13 hedge funds held shares or bullish call options in TACO a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jim Simons’s Renaissance Technologies has the largest position in Del Taco Restaurants Inc (NASDAQ:TACO), worth close to $7.2 million, corresponding to less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Woodson Capital Management, led by James Woodson Davis, holding a $3.8 million position; 0.8% of its 13F portfolio is allocated to the stock. Other peers with similar optimism encompass Israel Englander’s Millennium Management, Chuck Royce’s Royce & Associates and D. E. Shaw’s D E Shaw.

Judging by the fact that Del Taco Restaurants Inc (NASDAQ:TACO) has faced bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there were a few hedge funds that slashed their entire stakes in the third quarter. At the top of the heap, J. Carlo Cannell’s Cannell Capital dumped the biggest position of the “upper crust” of funds monitored by Insider Monkey, comprising close to $2.5 million in stock. Steve Cohen’s fund, Point72 Asset Management, also cut its stock, about $1.5 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 4 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to Del Taco Restaurants Inc (NASDAQ:TACO). These stocks are 3PEA International, Inc. (NASDAQ:TPNL), Cardlytics, Inc. (NASDAQ:CDLX), Zix Corporation (NASDAQ:ZIXI), and American Software, Inc. (NASDAQ:AMSWA). This group of stocks’ market valuations match TACO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPNL | 6 | 8071 | 3 |

| CDLX | 9 | 26098 | 3 |

| ZIXI | 21 | 70511 | 8 |

| AMSWA | 11 | 36281 | 3 |

| Average | 11.75 | 35240 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $35 million. That figure was $20 million in TACO’s case. Zix Corporation (NASDAQ:ZIXI) is the most popular stock in this table. On the other hand 3PEA International, Inc. (NASDAQ:TPNL) is the least popular one with only 6 bullish hedge fund positions. Del Taco Restaurants Inc (NASDAQ:TACO) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on TACO as the stock returned 14% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.