Is Cimarex Energy Co (NYSE:XEC) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

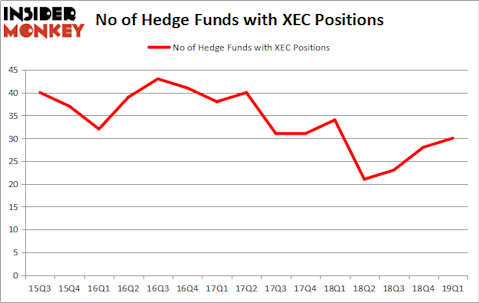

Cimarex Energy Co (NYSE:XEC) investors should be aware of an increase in hedge fund sentiment recently. Our calculations also showed that XEC isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to check out the fresh hedge fund action regarding Cimarex Energy Co (NYSE:XEC).

Hedge fund activity in Cimarex Energy Co (NYSE:XEC)

Heading into the second quarter of 2019, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the fourth quarter of 2018. On the other hand, there were a total of 34 hedge funds with a bullish position in XEC a year ago. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ric Dillon’s Diamond Hill Capital has the biggest position in Cimarex Energy Co (NYSE:XEC), worth close to $418.3 million, amounting to 2.3% of its total 13F portfolio. Coming in second is International Value Advisers, led by Charles de Vaulx, holding a $217.7 million position; 8.3% of its 13F portfolio is allocated to the company. Remaining peers that are bullish include Steve Cohen’s Point72 Asset Management, Phill Gross and Robert Atchinson’s Adage Capital Management and Matt Smith’s Deep Basin Capital.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Monarch Alternative Capital, managed by Michael Weinstock, created the largest position in Cimarex Energy Co (NYSE:XEC). Monarch Alternative Capital had $25.7 million invested in the company at the end of the quarter. Vince Maddi and Shawn Brennan’s SIR Capital Management also made a $3.5 million investment in the stock during the quarter. The other funds with new positions in the stock are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Andrew Weiss’s Weiss Asset Management, and Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk’s GRT Capital Partners.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Cimarex Energy Co (NYSE:XEC) but similarly valued. We will take a look at Hill-Rom Holdings, Inc. (NYSE:HRC), Signature Bank (NASDAQ:SBNY), Medical Properties Trust, Inc. (NYSE:MPW), and Tallgrass Energy, LP (NYSE:TGE). This group of stocks’ market caps are similar to XEC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HRC | 29 | 621941 | 0 |

| SBNY | 36 | 649446 | 0 |

| MPW | 13 | 220718 | -3 |

| TGE | 11 | 36489 | 3 |

| Average | 22.25 | 382149 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $382 million. That figure was $1100 million in XEC’s case. Signature Bank (NASDAQ:SBNY) is the most popular stock in this table. On the other hand Tallgrass Energy, LP (NYSE:TGE) is the least popular one with only 11 bullish hedge fund positions. Cimarex Energy Co (NYSE:XEC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately XEC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on XEC were disappointed as the stock returned -15.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.