Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space.

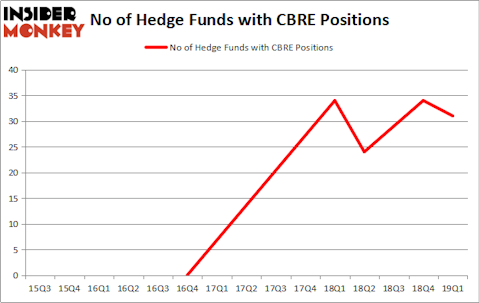

CBRE Group, Inc. (NYSE:CBRE) has seen a decrease in enthusiasm from smart money in recent months. CBRE was in 31 hedge funds’ portfolios at the end of the first quarter of 2019. There were 34 hedge funds in our database with CBRE positions at the end of the previous quarter. Our calculations also showed that CBRE isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are seen as slow, old investment vehicles of the past. While there are more than 8000 funds with their doors open at present, Our experts choose to focus on the leaders of this group, about 750 funds. These money managers direct the majority of the smart money’s total asset base, and by keeping track of their unrivaled picks, Insider Monkey has uncovered a number of investment strategies that have historically beaten the market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a glance at the new hedge fund action regarding CBRE Group, Inc. (NYSE:CBRE).

What have hedge funds been doing with CBRE Group, Inc. (NYSE:CBRE)?

At the end of the first quarter, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CBRE over the last 15 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

The largest stake in CBRE Group, Inc. (NYSE:CBRE) was held by ValueAct Capital, which reported holding $653.8 million worth of stock at the end of March. It was followed by Cantillon Capital Management with a $350.1 million position. Other investors bullish on the company included Ariel Investments, Millennium Management, and Citadel Investment Group.

Since CBRE Group, Inc. (NYSE:CBRE) has experienced bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of hedgies that elected to cut their entire stakes last quarter. Intriguingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital cut the biggest position of all the hedgies monitored by Insider Monkey, totaling close to $17.9 million in stock, and Kenneth Squire’s 13D Management was right behind this move, as the fund said goodbye to about $10.2 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 3 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to CBRE Group, Inc. (NYSE:CBRE). We will take a look at Restaurant Brands International Inc (NYSE:QSR), Keysight Technologies Inc (NYSE:KEYS), L-3 Technologies, Inc. (NYSE:LLL), and Garmin Ltd. (NASDAQ:GRMN). This group of stocks’ market values are closest to CBRE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QSR | 37 | 3609311 | 0 |

| KEYS | 37 | 967108 | 3 |

| LLL | 28 | 1233217 | 6 |

| GRMN | 27 | 512815 | -4 |

| Average | 32.25 | 1580613 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.25 hedge funds with bullish positions and the average amount invested in these stocks was $1581 million. That figure was $1403 million in CBRE’s case. Restaurant Brands International Inc (NYSE:QSR) is the most popular stock in this table. On the other hand Garmin Ltd. (NASDAQ:GRMN) is the least popular one with only 27 bullish hedge fund positions. CBRE Group, Inc. (NYSE:CBRE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately CBRE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); CBRE investors were disappointed as the stock returned -6.4% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.