Is Carlisle Companies, Inc. (NYSE:CSL) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

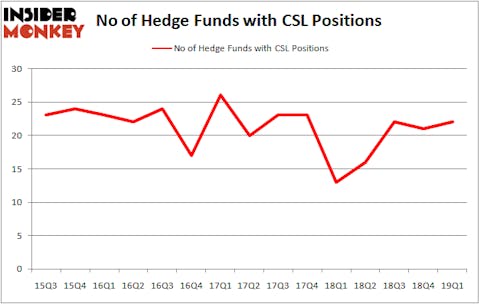

Carlisle Companies, Inc. (NYSE:CSL) has seen an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that CSL isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the fresh hedge fund action encompassing Carlisle Companies, Inc. (NYSE:CSL).

What does the smart money think about Carlisle Companies, Inc. (NYSE:CSL)?

Heading into the second quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from one quarter earlier. By comparison, 13 hedge funds held shares or bullish call options in CSL a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Richard S. Pzena’s Pzena Investment Management has the most valuable position in Carlisle Companies, Inc. (NYSE:CSL), worth close to $59.2 million, accounting for 0.3% of its total 13F portfolio. Sitting at the No. 2 spot is Select Equity Group, led by Robert Joseph Caruso, holding a $54.5 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Some other peers with similar optimism contain Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital and John Overdeck and David Siegel’s Two Sigma Advisors.

As industrywide interest jumped, specific money managers have jumped into Carlisle Companies, Inc. (NYSE:CSL) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the largest position in Carlisle Companies, Inc. (NYSE:CSL). Arrowstreet Capital had $33.5 million invested in the company at the end of the quarter. Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital also initiated a $21.6 million position during the quarter. The other funds with new positions in the stock are Noam Gottesman’s GLG Partners, Matthew Tewksbury’s Stevens Capital Management, and Joel Greenblatt’s Gotham Asset Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Carlisle Companies, Inc. (NYSE:CSL) but similarly valued. These stocks are Charles River Laboratories International Inc. (NYSE:CRL), The Madison Square Garden Company (NYSE:MSG), East West Bancorp, Inc. (NASDAQ:EWBC), and Cemex SAB de CV (NYSE:CX). All of these stocks’ market caps are closest to CSL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CRL | 24 | 994211 | -4 |

| MSG | 52 | 1778621 | 6 |

| EWBC | 29 | 437635 | 2 |

| CX | 15 | 90996 | 5 |

| Average | 30 | 825366 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $825 million. That figure was $252 million in CSL’s case. The Madison Square Garden Company (NYSE:MSG) is the most popular stock in this table. On the other hand Cemex SAB de CV (NYSE:CX) is the least popular one with only 15 bullish hedge fund positions. Carlisle Companies, Inc. (NYSE:CSL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on CSL as the stock returned 12% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.