The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their March 31 holdings, data that is available nowhere else. Should you consider Capital Senior Living Corporation (NYSE:CSU) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

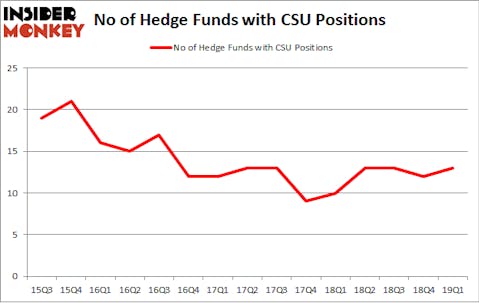

Capital Senior Living Corporation (NYSE:CSU) was in 13 hedge funds’ portfolios at the end of March. CSU has seen an increase in hedge fund sentiment recently. There were 12 hedge funds in our database with CSU holdings at the end of the previous quarter. Our calculations also showed that csu isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are assumed to be underperforming, outdated financial tools of years past. While there are more than 8000 funds with their doors open today, We look at the leaders of this club, about 750 funds. These hedge fund managers shepherd most of the hedge fund industry’s total capital, and by observing their best investments, Insider Monkey has spotted numerous investment strategies that have historically beaten the market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s review the recent hedge fund action regarding Capital Senior Living Corporation (NYSE:CSU).

Hedge fund activity in Capital Senior Living Corporation (NYSE:CSU)

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from one quarter earlier. By comparison, 10 hedge funds held shares or bullish call options in CSU a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Arbiter Partners Capital Management held the most valuable stake in Capital Senior Living Corporation (NYSE:CSU), which was worth $18 million at the end of the first quarter. On the second spot was Cove Street Capital which amassed $12.5 million worth of shares. Moreover, Coliseum Capital, Renaissance Technologies, and Levin Capital Strategies were also bullish on Capital Senior Living Corporation (NYSE:CSU), allocating a large percentage of their portfolios to this stock.

Now, specific money managers have been driving this bullishness. Weld Capital Management, managed by Minhua Zhang, initiated the most outsized position in Capital Senior Living Corporation (NYSE:CSU). Weld Capital Management had $0.1 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $0 million position during the quarter. The only other fund with a new position in the stock is Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Capital Senior Living Corporation (NYSE:CSU) but similarly valued. These stocks are Correvio Pharma Corp. (NASDAQ:CORV), Steel Connect, Inc. (NASDAQ:STCN), Matinas Biopharma Holdings, Inc. (NYSE:MTNB), and BioSig Technologies, Inc. (NASDAQ:BSGM). All of these stocks’ market caps are closest to CSU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CORV | 9 | 22097 | 2 |

| STCN | 5 | 42130 | 0 |

| MTNB | 7 | 13682 | 5 |

| BSGM | 1 | 862 | 0 |

| Average | 5.5 | 19693 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.5 hedge funds with bullish positions and the average amount invested in these stocks was $20 million. That figure was $43 million in CSU’s case. Correvio Pharma Corp. (NASDAQ:CORV) is the most popular stock in this table. On the other hand BioSig Technologies, Inc. (NASDAQ:BSGM) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Capital Senior Living Corporation (NYSE:CSU) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on CSU as the stock returned 10.8% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.