We at Insider Monkey have gone over 738 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of Callon Petroleum Company (NYSE:CPE) based on that data.

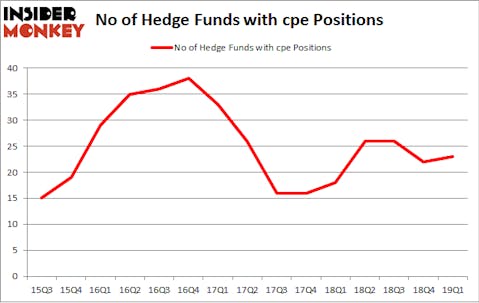

Callon Petroleum Company (NYSE:CPE) has experienced an increase in support from the world’s most elite money managers in recent months. CPE was in 23 hedge funds’ portfolios at the end of March. There were 22 hedge funds in our database with CPE positions at the end of the previous quarter. Our calculations also showed that cpe isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are viewed as unimportant, outdated investment tools of yesteryear. While there are more than 8000 funds trading today, Our experts choose to focus on the top tier of this group, approximately 750 funds. These money managers handle the majority of the hedge fund industry’s total asset base, and by tracking their highest performing investments, Insider Monkey has discovered a number of investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a look at the fresh hedge fund action surrounding Callon Petroleum Company (NYSE:CPE).

What does the smart money think about Callon Petroleum Company (NYSE:CPE)?

At the end of the first quarter, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CPE over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jonathan Barrett and Paul Segal’s Luminus Management has the biggest position in Callon Petroleum Company (NYSE:CPE), worth close to $64.2 million, comprising 1.4% of its total 13F portfolio. The second most bullish fund manager is Amy Minella of Cardinal Capital, with a $35.9 million position; 1.2% of its 13F portfolio is allocated to the stock. Remaining peers with similar optimism comprise Phill Gross and Robert Atchinson’s Adage Capital Management, Ken Fisher’s Fisher Asset Management and Principal Global Investors’s Columbus Circle Investors.

With a general bullishness amongst the heavyweights, key hedge funds have jumped into Callon Petroleum Company (NYSE:CPE) headfirst. Point72 Asset Management, managed by Steve Cohen, initiated the most valuable call position in Callon Petroleum Company (NYSE:CPE). Point72 Asset Management had $3.8 million invested in the company at the end of the quarter. Richard Driehaus’s Driehaus Capital also initiated a $2.6 million position during the quarter. The other funds with brand new CPE positions are Matthew Tewksbury’s Stevens Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s also examine hedge fund activity in other stocks similar to Callon Petroleum Company (NYSE:CPE). These stocks are Ensco Rowan plc (NYSE:ESV), UP Fintech Holding Limited (NASDAQ:TIGR), Zai Lab Limited (NASDAQ:ZLAB), and Fanhua Inc. (NASDAQ:FANH). This group of stocks’ market caps are closest to CPE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ESV | 21 | 248254 | -13 |

| TIGR | 9 | 13631 | 9 |

| ZLAB | 17 | 166562 | 1 |

| FANH | 10 | 15212 | 1 |

| Average | 14.25 | 110915 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $111 million. That figure was $192 million in CPE’s case. Ensco Rowan plc (NYSE:ESV) is the most popular stock in this table. On the other hand UP Fintech Holding Limited (NASDAQ:TIGR) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Callon Petroleum Company (NYSE:CPE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately CPE wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CPE were disappointed as the stock returned -14.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.