A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by nearly 7 percentage points during the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let’s study the hedge fund sentiment to see how those concerns affected their ownership of Brunswick Corporation (NYSE:BC) during the quarter.

Brunswick Corporation (NYSE:BC) has experienced a decrease in support from the world’s most elite money managers lately. Our calculations also showed that BC isn’t among the 30 most popular stocks among hedge funds.

To most shareholders, hedge funds are assumed to be unimportant, old financial tools of years past. While there are more than 8000 funds in operation at the moment, We hone in on the bigwigs of this club, about 750 funds. These investment experts orchestrate the majority of all hedge funds’ total capital, and by monitoring their top equity investments, Insider Monkey has formulated a few investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s go over the new hedge fund action encompassing Brunswick Corporation (NYSE:BC).

How are hedge funds trading Brunswick Corporation (NYSE:BC)?

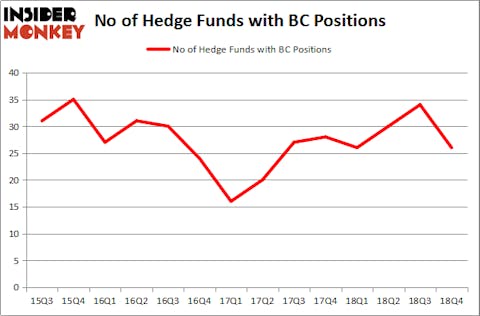

At the end of the fourth quarter, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -24% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards BC over the last 14 quarters. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

More specifically, Lakewood Capital Management was the largest shareholder of Brunswick Corporation (NYSE:BC), with a stake worth $102.7 million reported as of the end of September. Trailing Lakewood Capital Management was Adage Capital Management, which amassed a stake valued at $92.7 million. D E Shaw, AQR Capital Management, and Valueworks LLC were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Brunswick Corporation (NYSE:BC) has experienced falling interest from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of funds who were dropping their positions entirely last quarter. At the top of the heap, Ken Grossman and Glen Schneider’s SG Capital Management dumped the biggest stake of the 700 funds monitored by Insider Monkey, comprising about $18.5 million in stock, and Leon Cooperman’s Omega Advisors was right behind this move, as the fund sold off about $18.3 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 8 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Brunswick Corporation (NYSE:BC) but similarly valued. We will take a look at Janus Henderson Group plc (NYSE:JHG), Avnet, Inc. (NASDAQ:AVT), Manpowergroup Inc (NYSE:MAN), and Flex Ltd. (NASDAQ:FLEX). This group of stocks’ market caps match BC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JHG | 15 | 132302 | -2 |

| AVT | 24 | 581967 | 1 |

| MAN | 25 | 417727 | -3 |

| FLEX | 24 | 675508 | -2 |

| Average | 22 | 451876 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $452 million. That figure was $524 million in BC’s case. Manpowergroup Inc (NYSE:MAN) is the most popular stock in this table. On the other hand Janus Henderson Group plc (NYSE:JHG) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Brunswick Corporation (NYSE:BC) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately BC wasn’t nearly as popular as these 15 stock and hedge funds that were betting on BC were disappointed as the stock returned 13.5% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.