The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and famous investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Boise Cascade Co (NYSE:BCC) based on those filings.

Is Boise Cascade Co (NYSE:BCC) an attractive stock to buy now? Prominent investors are reducing their bets on the stock. The number of long hedge fund positions were cut by 2 in recent months. Our calculations also showed that BCC isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a glance at the recent hedge fund action surrounding Boise Cascade Co (NYSE:BCC).

How are hedge funds trading Boise Cascade Co (NYSE:BCC)?

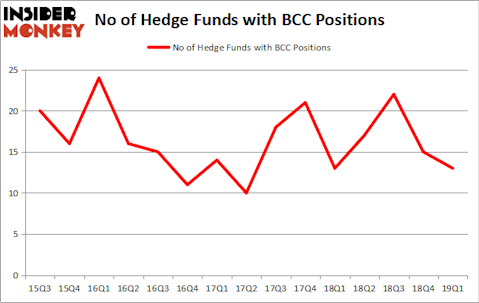

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BCC over the last 15 quarters. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in Boise Cascade Co (NYSE:BCC), which was worth $9.6 million at the end of the first quarter. On the second spot was Millennium Management which amassed $8.1 million worth of shares. Moreover, AQR Capital Management, Two Sigma Advisors, and Renaissance Technologies were also bullish on Boise Cascade Co (NYSE:BCC), allocating a large percentage of their portfolios to this stock.

Due to the fact that Boise Cascade Co (NYSE:BCC) has experienced a decline in interest from the smart money, logic holds that there was a specific group of money managers that elected to cut their full holdings by the end of the third quarter. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP dropped the biggest stake of the 700 funds watched by Insider Monkey, totaling about $0.4 million in stock, and Hoon Kim’s Quantinno Capital was right behind this move, as the fund dumped about $0.4 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 2 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Boise Cascade Co (NYSE:BCC) but similarly valued. We will take a look at Greenbrier Companies Inc (NYSE:GBX), NetGear, Inc. (NASDAQ:NTGR), Homology Medicines, Inc. (NASDAQ:FIXX), and New York Mortgage Trust, Inc. (NASDAQ:NYMT). This group of stocks’ market values resemble BCC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GBX | 11 | 28532 | 0 |

| NTGR | 16 | 22466 | 2 |

| FIXX | 7 | 200196 | -1 |

| NYMT | 6 | 15030 | -3 |

| Average | 10 | 66556 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $67 million. That figure was $39 million in BCC’s case. NetGear, Inc. (NASDAQ:NTGR) is the most popular stock in this table. On the other hand New York Mortgage Trust, Inc. (NASDAQ:NYMT) is the least popular one with only 6 bullish hedge fund positions. Boise Cascade Co (NYSE:BCC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately BCC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BCC were disappointed as the stock returned -6.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.