As we already know from media reports and hedge fund investor letters, many hedge funds lost money in fourth quarter, blaming macroeconomic conditions and unpredictable events that hit several sectors, with technology among them. Nevertheless, most investors decided to stick to their bullish theses and recouped their losses by the end of the first quarter. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about BMC Stock Holdings, Inc. (NASDAQ:BMCH).

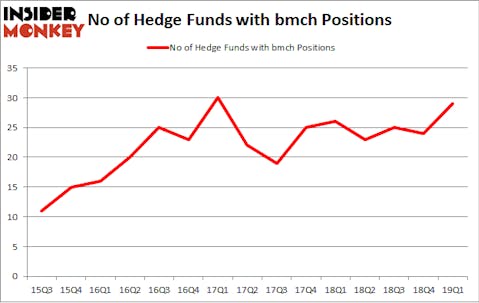

BMC Stock Holdings, Inc. (NASDAQ:BMCH) has seen an increase in support from the world’s most elite money managers lately. BMCH was in 29 hedge funds’ portfolios at the end of the first quarter of 2019. There were 24 hedge funds in our database with BMCH positions at the end of the previous quarter. Our calculations also showed that bmch isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the new hedge fund action regarding BMC Stock Holdings, Inc. (NASDAQ:BMCH).

How are hedge funds trading BMC Stock Holdings, Inc. (NASDAQ:BMCH)?

Heading into the second quarter of 2019, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 21% from the fourth quarter of 2018. By comparison, 26 hedge funds held shares or bullish call options in BMCH a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Lakewood Capital Management held the most valuable stake in BMC Stock Holdings, Inc. (NASDAQ:BMCH), which was worth $42.6 million at the end of the first quarter. On the second spot was Coliseum Capital which amassed $36.7 million worth of shares. Moreover, Raging Capital Management, MFP Investors, and Odey Asset Management Group were also bullish on BMC Stock Holdings, Inc. (NASDAQ:BMCH), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key money managers were breaking ground themselves. Point72 Asset Management, managed by Steve Cohen, established the most valuable position in BMC Stock Holdings, Inc. (NASDAQ:BMCH). Point72 Asset Management had $1.6 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $1.5 million investment in the stock during the quarter. The other funds with brand new BMCH positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Minhua Zhang’s Weld Capital Management, and Mike Vranos’s Ellington.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as BMC Stock Holdings, Inc. (NASDAQ:BMCH) but similarly valued. We will take a look at Studio City International Holdings Limited (NYSE:MSC), TherapeuticsMD Inc (NASDAQ:TXMD), Iovance Biotherapeutics, Inc. (NASDAQ:IOVA), and Alamo Group, Inc. (NYSE:ALG). This group of stocks’ market values resemble BMCH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MSC | 4 | 186155 | -1 |

| TXMD | 9 | 78464 | -1 |

| IOVA | 25 | 564470 | 3 |

| ALG | 10 | 196006 | -2 |

| Average | 12 | 256274 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $256 million. That figure was $210 million in BMCH’s case. Iovance Biotherapeutics, Inc. (NASDAQ:IOVA) is the most popular stock in this table. On the other hand Studio City International Holdings Limited (NYSE:MSC) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks BMC Stock Holdings, Inc. (NASDAQ:BMCH) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on BMCH as the stock returned 15.6% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.