At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

BB&T Corporation (NYSE:BBT) has experienced a decrease in support from the world’s most elite money managers of late. Our calculations also showed that bbt isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the fresh hedge fund action surrounding BB&T Corporation (NYSE:BBT).

How are hedge funds trading BB&T Corporation (NYSE:BBT)?

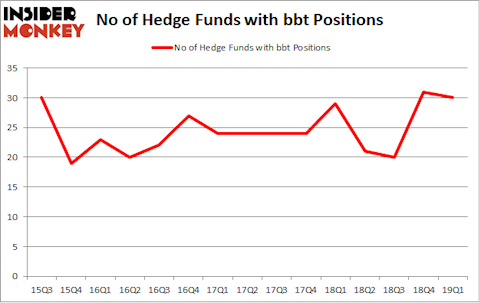

At the end of the first quarter, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from one quarter earlier. On the other hand, there were a total of 29 hedge funds with a bullish position in BBT a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jim Simons’s Renaissance Technologies has the number one position in BB&T Corporation (NYSE:BBT), worth close to $49.4 million, accounting for less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is John Overdeck and David Siegel of Two Sigma Advisors, with a $36.4 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining peers with similar optimism contain Noam Gottesman’s GLG Partners, and Steve Cohen’s Point72 Asset Management.

Because BB&T Corporation (NYSE:BBT) has witnessed a decline in interest from hedge fund managers, it’s safe to say that there lies a certain “tier” of hedgies who sold off their full holdings by the end of the third quarter. Intriguingly, Daniel Johnson’s Gillson Capital sold off the biggest investment of all the hedgies followed by Insider Monkey, worth close to $19.7 million in stock. Ravi Chopra’s fund, Azora Capital, also dumped its stock, about $14.1 million worth. These moves are important to note, as total hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to BB&T Corporation (NYSE:BBT). These stocks are Roper Technologies, Inc. (NYSE:ROP), Valero Energy Corporation (NYSE:VLO), Canadian Imperial Bank of Commerce (NYSE:CM), and Carnival Corporation (NYSE:CCL). This group of stocks’ market values match BBT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ROP | 22 | 709614 | -7 |

| VLO | 40 | 1375723 | 8 |

| CM | 15 | 321181 | 0 |

| CCL | 28 | 567796 | -11 |

| Average | 26.25 | 743579 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $744 million. That figure was $222 million in BBT’s case. Valero Energy Corporation (NYSE:VLO) is the most popular stock in this table. On the other hand Canadian Imperial Bank of Commerce (NYSE:CM) is the least popular one with only 15 bullish hedge fund positions. BB&T Corporation (NYSE:BBT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on BBT as the stock returned 2.5% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.