Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged during the first quarter. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 40% and 25% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the first 5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

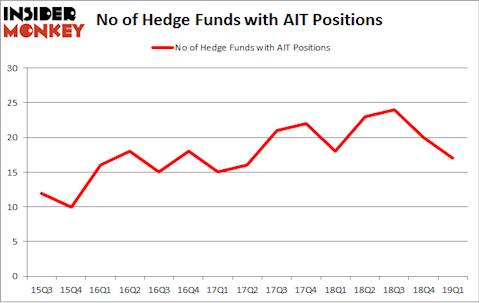

Applied Industrial Technologies, Inc. (NYSE:AIT) was in 17 hedge funds’ portfolios at the end of March. AIT investors should pay attention to a decrease in hedge fund sentiment lately. There were 20 hedge funds in our database with AIT holdings at the end of the previous quarter. Our calculations also showed that ait isn’t among the 30 most popular stocks among hedge funds.

Today there are dozens of indicators market participants put to use to evaluate their stock investments. Some of the less utilized indicators are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the best fund managers can beat their index-focused peers by a superb margin (see the details here).

Let’s take a look at the fresh hedge fund action regarding Applied Industrial Technologies, Inc. (NYSE:AIT).

How are hedge funds trading Applied Industrial Technologies, Inc. (NYSE:AIT)?

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -15% from the previous quarter. On the other hand, there were a total of 18 hedge funds with a bullish position in AIT a year ago. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Among these funds, Adage Capital Management held the most valuable stake in Applied Industrial Technologies, Inc. (NYSE:AIT), which was worth $34.5 million at the end of the first quarter. On the second spot was Balyasny Asset Management which amassed $23.7 million worth of shares. Moreover, Carlson Capital, Royce & Associates, and Millennium Management were also bullish on Applied Industrial Technologies, Inc. (NYSE:AIT), allocating a large percentage of their portfolios to this stock.

Since Applied Industrial Technologies, Inc. (NYSE:AIT) has experienced falling interest from hedge fund managers, we can see that there lies a certain “tier” of hedgies who were dropping their entire stakes last quarter. It’s worth mentioning that Jim Simons’s Renaissance Technologies dumped the biggest investment of the 700 funds monitored by Insider Monkey, totaling about $7.1 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund said goodbye to about $1.8 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 3 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Applied Industrial Technologies, Inc. (NYSE:AIT). We will take a look at Main Street Capital Corporation (NYSE:MAIN), Urban Edge Properties (NYSE:UE), CenterState Bank Corporation (NASDAQ:CSFL), and Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN). This group of stocks’ market caps match AIT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAIN | 4 | 9836 | -5 |

| UE | 14 | 97014 | 2 |

| CSFL | 16 | 136212 | -4 |

| BHVN | 33 | 386094 | 11 |

| Average | 16.75 | 157289 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $157 million. That figure was $110 million in AIT’s case. Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN) is the most popular stock in this table. On the other hand Main Street Capital Corporation (NYSE:MAIN) is the least popular one with only 4 bullish hedge fund positions. Applied Industrial Technologies, Inc. (NYSE:AIT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately AIT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on AIT were disappointed as the stock returned -1.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.