Insider Monkey has processed numerous 13F filings of hedge funds and successful investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of AMN Healthcare Services Inc (NYSE:AMN) based on that data.

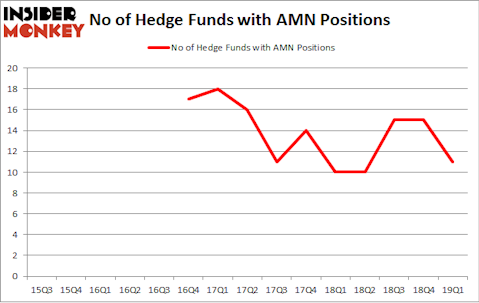

Is AMN Healthcare Services Inc (NYSE:AMN) a sound investment right now? Investors who are in the know are becoming less hopeful. The number of long hedge fund positions retreated by 4 in recent months. Our calculations also showed that amn isn’t among the 30 most popular stocks among hedge funds. AMN was in 11 hedge funds’ portfolios at the end of March. There were 15 hedge funds in our database with AMN positions at the end of the previous quarter.

To the average investor there are a lot of formulas market participants use to size up publicly traded companies. A duo of the most useful formulas are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the elite fund managers can outperform the market by a very impressive amount (see the details here).

Let’s review the key hedge fund action regarding AMN Healthcare Services Inc (NYSE:AMN).

How are hedge funds trading AMN Healthcare Services Inc (NYSE:AMN)?

At Q1’s end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -27% from one quarter earlier. On the other hand, there were a total of 10 hedge funds with a bullish position in AMN a year ago. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Israel Englander’s Millennium Management has the number one position in AMN Healthcare Services Inc (NYSE:AMN), worth close to $21.9 million, amounting to less than 0.1%% of its total 13F portfolio. Coming in second is Point72 Asset Management, led by Steve Cohen, holding a $21.7 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other professional money managers that are bullish include Chuck Royce’s Royce & Associates, Noam Gottesman’s GLG Partners and Israel Englander’s Millennium Management.

Judging by the fact that AMN Healthcare Services Inc (NYSE:AMN) has faced bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there exists a select few funds that decided to sell off their entire stakes heading into Q3. Intriguingly, Paul Marshall and Ian Wace’s Marshall Wace LLP dropped the largest investment of the 700 funds followed by Insider Monkey, worth an estimated $9.1 million in stock. David Costen Haley’s fund, HBK Investments, also sold off its stock, about $2.6 million worth. These transactions are important to note, as total hedge fund interest dropped by 4 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as AMN Healthcare Services Inc (NYSE:AMN) but similarly valued. We will take a look at Beacon Roofing Supply, Inc. (NASDAQ:BECN), Premier Inc (NASDAQ:PINC), WSFS Financial Corporation (NASDAQ:WSFS), and PTC Therapeutics, Inc. (NASDAQ:PTCT). All of these stocks’ market caps match AMN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BECN | 18 | 268055 | -3 |

| PINC | 16 | 163277 | -2 |

| WSFS | 20 | 178393 | 8 |

| PTCT | 31 | 647470 | 6 |

| Average | 21.25 | 314299 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $314 million. That figure was $69 million in AMN’s case. PTC Therapeutics, Inc. (NASDAQ:PTCT) is the most popular stock in this table. On the other hand Premier Inc (NASDAQ:PINC) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks AMN Healthcare Services Inc (NYSE:AMN) is even less popular than PINC. Hedge funds clearly dropped the ball on AMN as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on AMN as the stock returned 13.7% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.