It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 18.7% so far in 2019 and outperformed the S&P 500 ETF by 6.6 percentage points. We are done processing the latest 13f filings and in this article we will study how hedge fund sentiment towards American Tower Corporation (NYSE:AMT) changed during the first quarter.

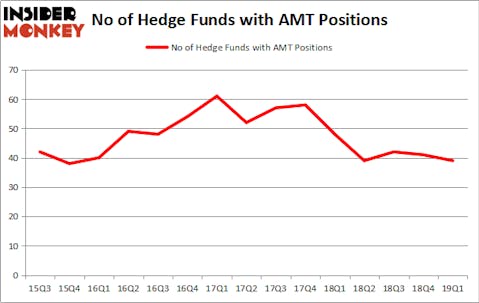

American Tower Corporation (NYSE:AMT) was in 39 hedge funds’ portfolios at the end of March. AMT has experienced a decrease in enthusiasm from smart money recently. There were 41 hedge funds in our database with AMT positions at the end of the previous quarter. Our calculations also showed that AMT isn’t among the 30 most popular stocks among hedge funds.

To most investors, hedge funds are assumed to be slow, outdated financial tools of years past. While there are over 8000 funds in operation at the moment, We choose to focus on the elite of this group, approximately 750 funds. It is estimated that this group of investors administer the lion’s share of all hedge funds’ total capital, and by tailing their inimitable equity investments, Insider Monkey has identified several investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s take a peek at the recent hedge fund action encompassing American Tower Corporation (NYSE:AMT).

What have hedge funds been doing with American Tower Corporation (NYSE:AMT)?

At Q1’s end, a total of 39 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AMT over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in American Tower Corporation (NYSE:AMT) was held by Akre Capital Management, which reported holding $1416.2 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $464.2 million position. Other investors bullish on the company included Cantillon Capital Management, Alkeon Capital Management, and AQR Capital Management.

Because American Tower Corporation (NYSE:AMT) has faced declining sentiment from the smart money, we can see that there were a few fund managers who sold off their positions entirely last quarter. Interestingly, Ryan Frick and Oliver Evans’s Dorsal Capital Management dropped the biggest stake of the “upper crust” of funds tracked by Insider Monkey, worth close to $63.3 million in stock, and Richard Driehaus’s Driehaus Capital was right behind this move, as the fund sold off about $8.2 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 2 funds last quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as American Tower Corporation (NYSE:AMT) but similarly valued. These stocks are Itau Unibanco Holding SA (NYSE:ITUB), Lockheed Martin Corporation (NYSE:LMT), Banco Santander (Brasil) SA (NYSE:BSBR), and Gilead Sciences, Inc. (NASDAQ:GILD). This group of stocks’ market valuations resemble AMT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ITUB | 21 | 1086598 | 3 |

| LMT | 35 | 1219528 | -7 |

| BSBR | 10 | 160949 | 0 |

| GILD | 58 | 3780289 | 1 |

| Average | 31 | 1561841 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $1562 million. That figure was $3022 million in AMT’s case. Gilead Sciences, Inc. (NASDAQ:GILD) is the most popular stock in this table. On the other hand Banco Santander (Brasil) SA (NYSE:BSBR) is the least popular one with only 10 bullish hedge fund positions. American Tower Corporation (NYSE:AMT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on AMT as the stock returned 4.3% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.