There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze American Homes 4 Rent (NYSE:AMH).

American Homes 4 Rent (NYSE:AMH) investors should be aware of an increase in activity from the world’s largest hedge funds of late. Our calculations also showed that amh isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s review the new hedge fund action surrounding American Homes 4 Rent (NYSE:AMH).

How have hedgies been trading American Homes 4 Rent (NYSE:AMH)?

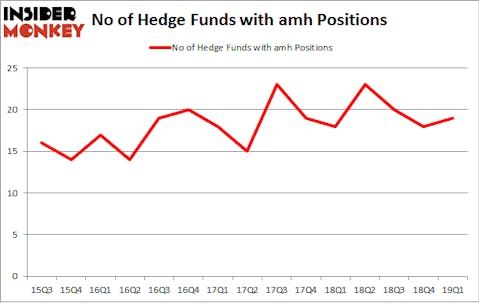

At the end of the first quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AMH over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Echo Street Capital Management held the most valuable stake in American Homes 4 Rent (NYSE:AMH), which was worth $97.9 million at the end of the first quarter. On the second spot was Long Pond Capital which amassed $74.6 million worth of shares. Moreover, AEW Capital Management, Citadel Investment Group, and Zimmer Partners were also bullish on American Homes 4 Rent (NYSE:AMH), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, some big names have been driving this bullishness. Zimmer Partners, managed by Stuart J. Zimmer, initiated the most outsized position in American Homes 4 Rent (NYSE:AMH). Zimmer Partners had $45.4 million invested in the company at the end of the quarter. Jonathan Litt’s Land & Buildings Investment Management also made a $17.9 million investment in the stock during the quarter. The other funds with brand new AMH positions are Richard Driehaus’s Driehaus Capital, Paul Tudor Jones’s Tudor Investment Corp, and David Harding’s Winton Capital Management.

Let’s go over hedge fund activity in other stocks similar to American Homes 4 Rent (NYSE:AMH). We will take a look at Proofpoint Inc (NASDAQ:PFPT), Dr. Reddy’s Laboratories Limited (NYSE:RDY), Israel Chemicals Ltd. (NYSE:ICL), and Fortune Brands Home & Security Inc (NYSE:FBHS). All of these stocks’ market caps are similar to AMH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PFPT | 33 | 659720 | 6 |

| RDY | 11 | 91252 | 1 |

| ICL | 4 | 54026 | -1 |

| FBHS | 29 | 568628 | -2 |

| Average | 19.25 | 343407 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $343 million. That figure was $462 million in AMH’s case. Proofpoint Inc (NASDAQ:PFPT) is the most popular stock in this table. On the other hand Israel Chemicals Ltd. (NYSE:ICL) is the least popular one with only 4 bullish hedge fund positions. American Homes 4 Rent (NYSE:AMH) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on AMH as the stock returned 6.2% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.