At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of March 31. In this article, we will use that wealth of knowledge to determine whether or not Alliant Energy Corporation (NASDAQ:LNT) makes for a good investment right now.

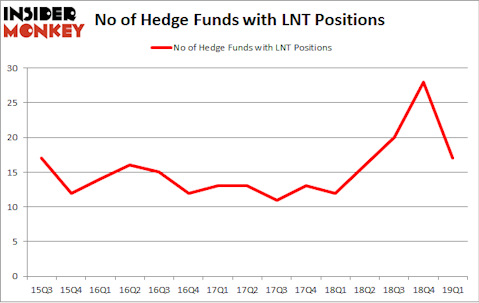

Alliant Energy Corporation (NASDAQ:LNT) was in 17 hedge funds’ portfolios at the end of the first quarter of 2019. LNT investors should pay attention to a decrease in support from the world’s most elite money managers of late. There were 28 hedge funds in our database with LNT holdings at the end of the previous quarter. Our calculations also showed that lnt isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Stuart Zimmer of Zimmer Partners

We’re going to take a look at the new hedge fund action surrounding Alliant Energy Corporation (NASDAQ:LNT).

How are hedge funds trading Alliant Energy Corporation (NASDAQ:LNT)?

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -39% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards LNT over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

The largest stake in Alliant Energy Corporation (NASDAQ:LNT) was held by Citadel Investment Group, which reported holding $174.8 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $139.8 million position. Other investors bullish on the company included Millennium Management, Zimmer Partners, and Carlson Capital.

Due to the fact that Alliant Energy Corporation (NASDAQ:LNT) has witnessed declining sentiment from the aggregate hedge fund industry, we can see that there was a specific group of money managers that slashed their full holdings in the third quarter. At the top of the heap, Jonathan Barrett and Paul Segal’s Luminus Management said goodbye to the largest stake of the 700 funds tracked by Insider Monkey, worth close to $21.6 million in stock. Peter Muller’s fund, PDT Partners, also dropped its stock, about $8.8 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 11 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Alliant Energy Corporation (NASDAQ:LNT) but similarly valued. We will take a look at InterContinental Hotels Group PLC (NYSE:IHG), DENTSPLY SIRONA Inc. (NASDAQ:XRAY), Melco Resorts & Entertainment Limited (NASDAQ:MLCO), and Paycom Software Inc (NYSE:PAYC). This group of stocks’ market caps match LNT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IHG | 5 | 21218 | -2 |

| XRAY | 31 | 1834188 | 4 |

| MLCO | 22 | 394196 | 1 |

| PAYC | 25 | 318253 | 6 |

| Average | 20.75 | 641964 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $642 million. That figure was $608 million in LNT’s case. DENTSPLY SIRONA Inc. (NASDAQ:XRAY) is the most popular stock in this table. On the other hand InterContinental Hotels Group PLC (NYSE:IHG) is the least popular one with only 5 bullish hedge fund positions. Alliant Energy Corporation (NASDAQ:LNT) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on LNT, though not to the same extent, as the stock returned 6.1% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.