Is Aircastle Limited (NYSE:AYR) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

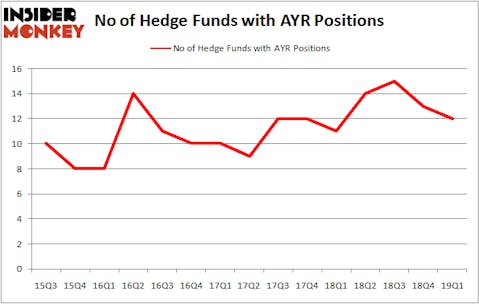

Aircastle Limited (NYSE:AYR) investors should pay attention to a decrease in hedge fund sentiment recently. Our calculations also showed that AYR isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several formulas stock market investors use to grade stocks. Two of the most under-the-radar formulas are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the best investment managers can outperform the broader indices by a superb margin (see the details here).

We’re going to take a look at the key hedge fund action encompassing Aircastle Limited (NYSE:AYR).

How have hedgies been trading Aircastle Limited (NYSE:AYR)?

Heading into the second quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from the fourth quarter of 2018. By comparison, 11 hedge funds held shares or bullish call options in AYR a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, Diamond Hill Capital was the largest shareholder of Aircastle Limited (NYSE:AYR), with a stake worth $49.4 million reported as of the end of March. Trailing Diamond Hill Capital was Goodnow Investment Group, which amassed a stake valued at $18.4 million. Millennium Management, Two Sigma Advisors, and Arrowstreet Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Because Aircastle Limited (NYSE:AYR) has faced a decline in interest from hedge fund managers, logic holds that there were a few funds that elected to cut their full holdings heading into Q3. At the top of the heap, Brandon Haley’s Holocene Advisors dumped the largest investment of the “upper crust” of funds tracked by Insider Monkey, worth an estimated $0.7 million in stock, and D. E. Shaw’s D E Shaw was right behind this move, as the fund said goodbye to about $0.5 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 1 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Aircastle Limited (NYSE:AYR). These stocks are Vector Group Ltd (NYSE:VGR), trivago N.V. (NASDAQ:TRVG), Rush Enterprises, Inc. (NASDAQ:RUSHB), and BP Midstream Partners LP (NYSE:BPMP). This group of stocks’ market valuations are closest to AYR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VGR | 22 | 171934 | 2 |

| TRVG | 11 | 120462 | -2 |

| RUSHB | 3 | 37215 | 0 |

| BPMP | 6 | 45284 | 3 |

| Average | 10.5 | 93724 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $94 million. That figure was $82 million in AYR’s case. Vector Group Ltd (NYSE:VGR) is the most popular stock in this table. On the other hand Rush Enterprises, Inc. (NASDAQ:RUSHB) is the least popular one with only 3 bullish hedge fund positions. Aircastle Limited (NYSE:AYR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on AYR, though not to the same extent, as the stock returned 4.5% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.