Is Vista Outdoor Inc (NYSE:VSTO) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

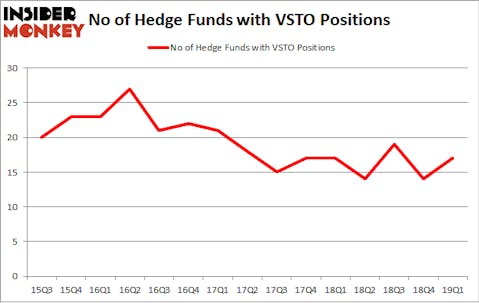

Vista Outdoor Inc (NYSE:VSTO) shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. VSTO was in 17 hedge funds’ portfolios at the end of March. There were 14 hedge funds in our database with VSTO positions at the end of the previous quarter. Our calculations also showed that vsto isn’t among the 30 most popular stocks among hedge funds.

To most investors, hedge funds are perceived as slow, old financial vehicles of yesteryear. While there are more than 8000 funds with their doors open at present, Our experts hone in on the moguls of this group, around 750 funds. These investment experts administer the majority of the hedge fund industry’s total asset base, and by paying attention to their highest performing picks, Insider Monkey has determined various investment strategies that have historically outpaced the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s take a peek at the latest hedge fund action surrounding Vista Outdoor Inc (NYSE:VSTO).

What have hedge funds been doing with Vista Outdoor Inc (NYSE:VSTO)?

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 21% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards VSTO over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Vista Outdoor Inc (NYSE:VSTO) was held by D E Shaw, which reported holding $9.5 million worth of stock at the end of March. It was followed by Fairholme (FAIRX) with a $9.3 million position. Other investors bullish on the company included Mountain Lake Investment Management, Arrowstreet Capital, and Renaissance Technologies.

Consequently, key hedge funds have jumped into Vista Outdoor Inc (NYSE:VSTO) headfirst. PDT Partners, managed by Peter Muller, assembled the most valuable position in Vista Outdoor Inc (NYSE:VSTO). PDT Partners had $0.6 million invested in the company at the end of the quarter. Mike Vranos’s Ellington also initiated a $0.5 million position during the quarter. The other funds with new positions in the stock are Jon Bauer’s Contrarian Capital, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Vista Outdoor Inc (NYSE:VSTO) but similarly valued. We will take a look at Sinovac Biotech Ltd. (NASDAQ:SVA), Vera Bradley, Inc. (NASDAQ:VRA), United Community Financial Corp (NASDAQ:UCFC), and Tejon Ranch Company (NYSE:TRC). All of these stocks’ market caps are similar to VSTO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SVA | 3 | 71917 | -1 |

| VRA | 18 | 70091 | 1 |

| UCFC | 11 | 29850 | 3 |

| TRC | 11 | 80881 | -1 |

| Average | 10.75 | 63185 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $63 million. That figure was $45 million in VSTO’s case. Vera Bradley, Inc. (NASDAQ:VRA) is the most popular stock in this table. On the other hand Sinovac Biotech Ltd. (NASDAQ:SVA) is the least popular one with only 3 bullish hedge fund positions. Vista Outdoor Inc (NYSE:VSTO) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately VSTO wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on VSTO were disappointed as the stock returned 1.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.