Wasatch Global Investors, an investment management firm, published its “Wasatch Small Cap Growth Fund” fourth quarter 2021 investor letter – a copy of which can be downloaded here. During the fourth quarter, the benchmark Russell 2000® Growth Index rose 0.01% while the Russell 2000 Index increased 2.14%. Underperforming its benchmark, the Wasatch Small Cap Growth Fund— Investor Class slipped -1.42%. For the one-year period ended December 31, 2021, the Fund’s Investor Class gained 8.32% compared to the 2.83% increase in the Russell 2000 Growth Index and the 14.82% rise in the Russell 2000 Index. Spare some time to check the fund’s top 5 holdings to have a clue about their top bets for 2022.

Wasatch Small Cap Growth Fund, in its Q4 2021 investor letter, mentioned Medpace Holdings, Inc. (NASDAQ: MEDP) and discussed its stance on the firm. Medpace Holdings, Inc. is a Cincinnati, Ohio-based clinical contract research organization with a $5.2 billion market capitalization. MEDP delivered a -31.74% return since the beginning of the year, while its 12-month returns are down by -1.09%. The stock closed at $148.57 per share on March 07, 2022.

Here is what Wasatch Small Cap Growth Fund has to say about Medpace Holdings, Inc. in its Q4 2021 investor letter:

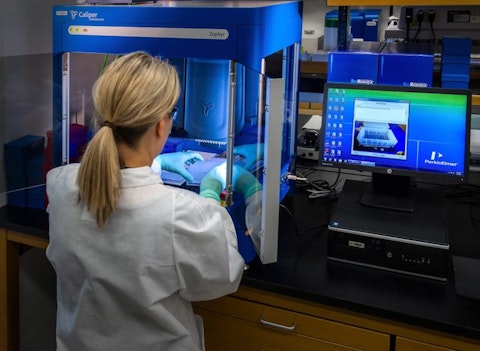

“Another significant contributor was Medpace Holdings, Inc. (MEDP)—which provides life-sciences services including management and monitoring of clinical trials, regulatory submissions, quality assurance and other services designed to increase the efficiency of organizations’ research processes. In its most recent financial announcement, the company reported significant growth in net revenues and a substantial increase in net new business wins compared to the same period a year ago. This was especially welcome news because Medpace had previously incurred losses as the company laid the groundwork for future success. We believe Medpace should continue to benefit from its role as a facilitator of fundamental research functions. In addition to the company’s strong management, we like the fact that Medpace serves small biotechnology companies and gives us some exposure to the biotech industry without the often “all or nothing” nature of the industry.”

Our calculations show that Medpace Holdings, Inc. (NASDAQ: MEDP) failed to obtain a mark on our list of the 30 Most Popular Stocks Among Hedge Funds. MEDP was in 26 hedge fund portfolios at the end of the fourth quarter of 2021, compared to 23 funds in the previous quarter. Medpace Holdings, Inc. (NASDAQ: MEDP) delivered a -27.52% return in the past 3 months.

In August 2021, we also shared another hedge fund’s views on MEDP in another article. You can find other letters from hedge funds and prominent investors on our hedge fund investor letters 2021 Q4 page.

Disclosure: None. This article is originally published at Insider Monkey.