We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of Zumiez Inc. (NASDAQ:ZUMZ) based on that data.

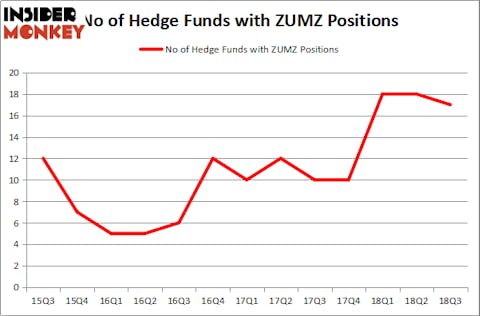

Is Zumiez Inc. (NASDAQ:ZUMZ) a healthy stock for your portfolio? The best stock pickers are selling. The number of bullish hedge fund bets went down by 1 lately. Our calculations also showed that ZUMZ isn’t among the 30 most popular stocks among hedge funds. ZUMZ was in 17 hedge funds’ portfolios at the end of September. There were 18 hedge funds in our database with ZUMZ holdings at the end of the previous quarter.

At the moment there are tons of signals market participants can use to value stocks. Two of the most innovative signals are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the best investment managers can outclass the broader indices by a healthy amount (see the details here).

Let’s go over the key hedge fund action regarding Zumiez Inc. (NASDAQ:ZUMZ).

How are hedge funds trading Zumiez Inc. (NASDAQ:ZUMZ)?

At Q3’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -6% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ZUMZ over the last 13 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Zumiez Inc. (NASDAQ:ZUMZ), with a stake worth $18.8 million reported as of the end of September. Trailing Renaissance Technologies was GLG Partners, which amassed a stake valued at $10.2 million. AQR Capital Management, Citadel Investment Group, and Maverick Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Zumiez Inc. (NASDAQ:ZUMZ) has witnessed declining sentiment from the entirety of the hedge funds we track, we can see that there was a specific group of hedgies that slashed their full holdings by the end of the third quarter. At the top of the heap, Richard Driehaus’s Driehaus Capital cut the largest investment of the “upper crust” of funds monitored by Insider Monkey, comprising an estimated $5.6 million in call options. Matthew Hulsizer’s fund, PEAK6 Capital Management, also said goodbye to its call options, about $0.6 million worth. These moves are interesting, as total hedge fund interest was cut by 1 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Zumiez Inc. (NASDAQ:ZUMZ) but similarly valued. We will take a look at ANI Pharmaceuticals Inc (NASDAQ:ANIP), Argan, Inc. (NYSEAMEX:AGX), Dime Community Bancshares, Inc. (NASDAQ:DCOM), and Kura Oncology, Inc. (NASDAQ:KURA). This group of stocks’ market valuations resemble ZUMZ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ANIP | 17 | 59526 | 6 |

| AGX | 17 | 117752 | 0 |

| DCOM | 13 | 43461 | 1 |

| KURA | 20 | 217308 | 2 |

| Average | 16.75 | 109512 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $110 million. That figure was $50 million in ZUMZ’s case. Kura Oncology, Inc. (NASDAQ:KURA) is the most popular stock in this table. On the other hand Dime Community Bancshares, Inc. (NASDAQ:DCOM) is the least popular one with only 13 bullish hedge fund positions. Zumiez Inc. (NASDAQ:ZUMZ) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KURA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.