Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 20 stock picks easily bested the broader market, at 18.7% compared to 12.1%, despite there being a few duds in there like Berkshire Hathaway (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

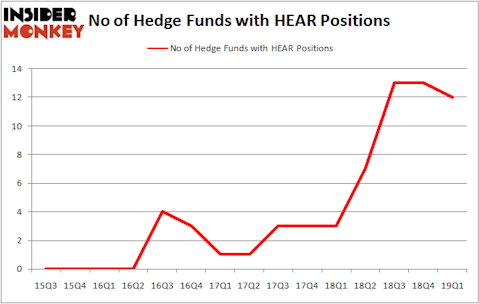

Is Turtle Beach Corp (NASDAQ:HEAR) a superb stock to buy now? Prominent investors are becoming less confident. The number of bullish hedge fund positions went down by 1 in recent months. Our calculations also showed that HEAR isn’t among the 30 most popular stocks among hedge funds. HEAR was in 12 hedge funds’ portfolios at the end of March. There were 13 hedge funds in our database with HEAR positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a glance at the recent hedge fund action regarding Turtle Beach Corp (NASDAQ:HEAR).

What have hedge funds been doing with Turtle Beach Corp (NASDAQ:HEAR)?

Heading into the second quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from the fourth quarter of 2018. By comparison, 3 hedge funds held shares or bullish call options in HEAR a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Newtyn Management held the most valuable stake in Turtle Beach Corp (NASDAQ:HEAR), which was worth $6 million at the end of the first quarter. On the second spot was AQR Capital Management which amassed $3.7 million worth of shares. Moreover, Manatuck Hill Partners, Millennium Management, and Citadel Investment Group were also bullish on Turtle Beach Corp (NASDAQ:HEAR), allocating a large percentage of their portfolios to this stock.

Since Turtle Beach Corp (NASDAQ:HEAR) has faced falling interest from the smart money, it’s safe to say that there exists a select few funds who were dropping their positions entirely heading into Q3. It’s worth mentioning that Joseph A. Jolson’s Harvest Capital Strategies said goodbye to the biggest investment of the “upper crust” of funds tracked by Insider Monkey, comprising about $3.7 million in stock. Ken Griffin’s fund, Citadel Investment Group, also dumped its stock, about $0.2 million worth. These moves are important to note, as total hedge fund interest fell by 1 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to Turtle Beach Corp (NASDAQ:HEAR). We will take a look at Ekso Bionics Holdings, Inc. (NASDAQ:EKSO), Ultralife Corp. (NASDAQ:ULBI), MVC Capital, Inc. (NYSE:MVC), and Cue Biopharma, Inc. (NASDAQ:CUE). This group of stocks’ market caps are closest to HEAR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EKSO | 7 | 52278 | 5 |

| ULBI | 7 | 5883 | 3 |

| MVC | 8 | 47295 | 0 |

| CUE | 2 | 6874 | 1 |

| Average | 6 | 28083 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $28 million. That figure was $21 million in HEAR’s case. MVC Capital, Inc. (NYSE:MVC) is the most popular stock in this table. On the other hand Cue Biopharma, Inc. (NASDAQ:CUE) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Turtle Beach Corp (NASDAQ:HEAR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately HEAR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on HEAR were disappointed as the stock returned 0.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.