Is The Western Union Company (NYSE:WU) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments (for some reason media paid a ton of attention to Ackman’s gigantic JC Penney and Valeant failures) and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

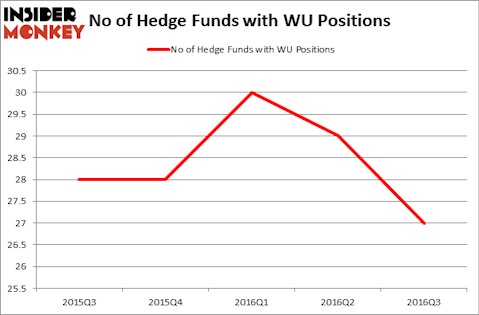

Is The Western Union Company (NYSE:WU) a healthy stock for your portfolio? The smart money is taking a pessimistic view. The number of long hedge fund positions retreated by 2 recently. WU was in 27 hedge funds’ portfolios at the end of September. There were 29 hedge funds in our database with WU positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Lululemon Athletica inc. (NASDAQ:LULU), Verisign, Inc. (NASDAQ:VRSN), and Tripadvisor Inc (NASDAQ:TRIP) to gather more data points.

Follow Western Union Co (NYSE:WU)

Follow Western Union Co (NYSE:WU)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Fer Gregory/Shutterstock.com

How have hedgies been trading The Western Union Company (NYSE:WU)?

At Q3’s end, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a 7% decline from one quarter earlier, pushing hedge fund ownership to a yearly low, though the range of ownership is narrow. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, David Abrams’ Abrams Capital Management has the number one position in The Western Union Company (NYSE:WU), worth close to $449.9 million, comprising 22.3% of its total 13F portfolio. The second most bullish fund manager is Ariel Investments, led by John W. Rogers, holding a $129.2 million position; 1.6% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish consist of David Harding’s Winton Capital Management, Joel Greenblatt’s Gotham Asset Management, and Bernard Horn’s Polaris Capital Management.

Because The Western Union Company (NYSE:WU) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there were a few hedgies who sold off their entire stakes in the third quarter. At the top of the heap, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the largest stake of all the hedgies monitored by Insider Monkey, worth about $9.6 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also cut its stock, about $9.1 million worth. These moves are important to note, as aggregate hedge fund interest was cut by 2 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to The Western Union Company (NYSE:WU). These stocks are Lululemon Athletica inc. (NASDAQ:LULU), Verisign, Inc. (NASDAQ:VRSN), Tripadvisor Inc (NASDAQ:TRIP), and Ingredion Inc (NYSE:INGR). This group of stocks’ market valuations are similar to WU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LULU | 26 | 679455 | -2 |

| VRSN | 26 | 2169028 | -4 |

| TRIP | 40 | 853214 | 7 |

| INGR | 23 | 406753 | 5 |

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1.03 billion. That figure was $785 million in WU’s case. Tripadvisor Inc (NASDAQ:TRIP) is the most popular stock in this table. On the other hand Ingredion Inc (NYSE:INGR) is the least popular one with only 23 bullish hedge fund positions. The Western Union Company (NYSE:WU) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TRIP might be a better candidate to consider a long position in.

Disclosure: None