Out of thousands of stocks that are currently traded on the market, it is difficult to determine those that can really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of over 700 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Skechers USA Inc (NYSE:SKX).

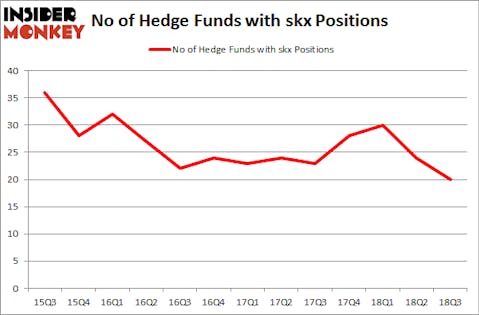

Is Skechers USA Inc (NYSE:SKX) a splendid investment right now? Investors who are in the know are in a pessimistic mood. The number of long hedge fund bets shrunk by 4 recently. Our calculations also showed that skx isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are perceived as worthless, old investment tools of yesteryear. While there are more than 8,000 funds trading today, Our experts choose to focus on the masters of this club, approximately 700 funds. Most estimates calculate that this group of people handle the lion’s share of all hedge funds’ total asset base, and by keeping track of their first-class equity investments, Insider Monkey has come up with many investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to view the latest hedge fund action surrounding Skechers USA Inc (NYSE:SKX).

Hedge fund activity in Skechers USA Inc (NYSE:SKX)

At Q3’s end, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -17% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards SKX over the last 13 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

The largest stake in Skechers USA Inc (NYSE:SKX) was held by AQR Capital Management, which reported holding $131.9 million worth of stock at the end of September. It was followed by Portolan Capital Management with a $23.6 million position. Other investors bullish on the company included Tremblant Capital, Gotham Asset Management, and Millennium Management.

Because Skechers USA Inc (NYSE:SKX) has faced a decline in interest from the smart money, it’s easy to see that there is a sect of money managers that slashed their positions entirely last quarter. Intriguingly, David Keidan’s Buckingham Capital Management sold off the biggest investment of the 700 funds tracked by Insider Monkey, comprising about $21.7 million in stock. Richard Barrera’s fund, Roystone Capital Partners, also dropped its stock, about $15.1 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 4 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Skechers USA Inc (NYSE:SKX) but similarly valued. We will take a look at JBG SMITH Properties (NYSE:JBGS), Life Storage, Inc. (NYSE:LSI), Bemis Company, Inc. (NYSE:BMS), and Ryman Hospitality Properties, Inc. (NYSE:RHP). All of these stocks’ market caps resemble SKX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JBGS | 17 | 280134 | 2 |

| LSI | 12 | 126980 | -4 |

| BMS | 26 | 399893 | 7 |

| RHP | 24 | 605287 | 7 |

| Average | 19.75 | 353074 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $353 million. That figure was $236 million in SKX’s case. Bemis Company, Inc. (NYSE:BMS) is the most popular stock in this table. On the other hand Life Storage, Inc. (NYSE:LSI) is the least popular one with only 12 bullish hedge fund positions. Skechers USA Inc (NYSE:SKX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BMS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.