At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Sandstorm Gold Ltd. (NYSE:SAND) has seen an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that SAND isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a multitude of indicators stock market investors have at their disposal to appraise publicly traded companies. Some of the less known indicators are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the top hedge fund managers can outpace their index-focused peers by a solid amount (see the details here).

We’re going to take a peek at the key hedge fund action regarding Sandstorm Gold Ltd. (NYSE:SAND).

What does smart money think about Sandstorm Gold Ltd. (NYSE:SAND)?

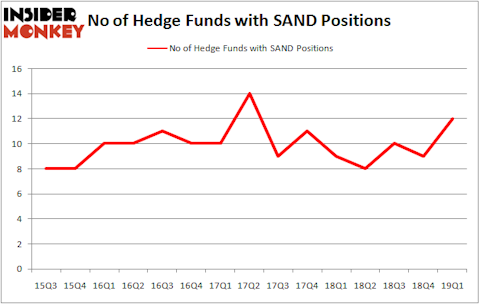

At Q1’s end, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in SAND over the last 15 quarters. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

Among these funds, Sprott Asset Management held the most valuable stake in Sandstorm Gold Ltd. (NYSE:SAND), which was worth $14.4 million at the end of the first quarter. On the second spot was Horizon Asset Management which amassed $11.8 million worth of shares. Moreover, Waratah Capital Advisors, Royce & Associates, and Citadel Investment Group were also bullish on Sandstorm Gold Ltd. (NYSE:SAND), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were breaking ground themselves. Waratah Capital Advisors, managed by Brad Dunkley and Blair Levinsky, created the most valuable position in Sandstorm Gold Ltd. (NYSE:SAND). Waratah Capital Advisors had $10 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also made a $0.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management, Ronald Hua’s Qtron Investments, and Joel Greenblatt’s Gotham Asset Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Sandstorm Gold Ltd. (NYSE:SAND) but similarly valued. These stocks are Hailiang Education Group Inc. (NASDAQ:HLG), Bain Capital Specialty Finance, Inc. (NYSE:BCSF), Playa Hotels & Resorts N.V. (NASDAQ:PLYA), and Clementia Pharmaceuticals Inc. (NASDAQ:CMTA). This group of stocks’ market values match SAND’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HLG | 3 | 5277 | 0 |

| BCSF | 2 | 29694 | -1 |

| PLYA | 19 | 415878 | -1 |

| CMTA | 15 | 456920 | 3 |

| Average | 9.75 | 226942 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $227 million. That figure was $45 million in SAND’s case. Playa Hotels & Resorts N.V. (NASDAQ:PLYA) is the most popular stock in this table. On the other hand Bain Capital Specialty Finance, Inc. (NYSE:BCSF) is the least popular one with only 2 bullish hedge fund positions. Sandstorm Gold Ltd. (NYSE:SAND) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately SAND wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SAND were disappointed as the stock returned 1.1% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.