Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility and underperformance. The time period between the end of June 2015 and the end of June 2016 was one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have been underperforming the large-cap indices. However, things have dramatically changed over the last 5 months. Small-cap stocks reversed their misfortune and beat the large cap indices by almost 11 percentage points since the end of June. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Regions Financial Corp (NYSE:RF) .

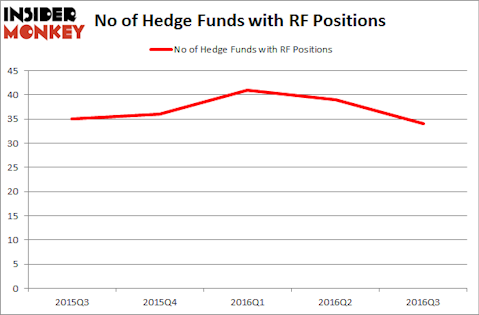

Regions Financial Corp (NYSE:RF) was in 34 hedge funds’ portfolios at the end of the third quarter of 2016. RF has seen a decrease in hedge fund sentiment recently. There were 39 hedge funds in our database with RF holdings at the end of the previous quarter. At the end of this article we will also compare RF to other stocks including Church & Dwight Co., Inc. (NYSE:CHD), Chipotle Mexican Grill, Inc. (NYSE:CMG), and Whirlpool Corporation (NYSE:WHR) to get a better sense of its popularity.

Follow Regions Financial Corp (NYSE:RF)

Follow Regions Financial Corp (NYSE:RF)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

TZIDO SUN/Shutterstock.com

Now, we’re going to go over the key action surrounding Regions Financial Corp (NYSE:RF).

How have hedgies been trading Regions Financial Corp (NYSE:RF)?

Heading into the fourth quarter of 2016, a total of 34 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 13% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards RF over the last 5 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Matthew Lindenbaum’s Basswood Capital has the largest position in Regions Financial Corp (NYSE:RF), worth close to $303.6 million, accounting for 14.5% of its total 13F portfolio. Sitting at the No. 2 spot is Richard S. Pzena of Pzena Investment Management, with a $270.9 million position; the fund has 1.7% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish contain Cliff Asness’s AQR Capital Management, Paul Marshall and Ian Wace’s Marshall Wace LLP and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Because Regions Financial Corp (NYSE:RF) has faced bearish sentiment from hedge fund managers, it’s easy to see that there was a specific group of hedgies who sold off their entire stakes last quarter. Intriguingly, Peter Muller’s PDT Partners dropped the biggest stake of the 700 funds followed by Insider Monkey, valued at close to $15.3 million in stock. Robert Pohly’s fund, Samlyn Capital, also dumped its call options, worth about $14.5 million.

Let’s check out hedge fund activity in other stocks similar to Regions Financial Corp (NYSE:RF). We will take a look at Church & Dwight Co., Inc. (NYSE:CHD), Chipotle Mexican Grill, Inc. (NYSE:CMG), Whirlpool Corporation (NYSE:WHR), and Agnico-Eagle Mines Limited (USA) (NYSE:AEM). This group of stocks’ market caps are closest to RF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHD | 18 | 269513 | -2 |

| CMG | 41 | 1595089 | 2 |

| WHR | 34 | 1469379 | -3 |

| AEM | 25 | 500237 | -4 |

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $959 million. That figure was $824 million in RF’s case. Chipotle Mexican Grill, Inc. (NYSE:CMG) is the most popular stock in this table. On the other hand Church & Dwight Co., Inc. (NYSE:CHD) is the least popular one with only 18 bullish hedge fund positions. Regions Financial Corp (NYSE:RF) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CMG might be a better candidate to consider taking a long position in.

Disclosure: none.