The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, a week after the market trough. In this article we look at what those investors think of Plexus Corp. (NASDAQ:PLXS).

Is Plexus Corp. (NASDAQ:PLXS) a buy right now? The best stock pickers are turning less bullish. The number of long hedge fund positions went down by 8 lately. Our calculations also showed that PLXS isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Today there are many methods stock market investors can use to analyze publicly traded companies. A couple of the less known methods are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the elite fund managers can outclass the broader indices by a significant margin (see the details here).

David Harding of Winton Capital Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, we take a look at lists like the 10 largest producers of bauxite to identify emerging trends that are likely to lead to 1000% gains in the coming years. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a look at the new hedge fund action encompassing Plexus Corp. (NASDAQ:PLXS).

Hedge fund activity in Plexus Corp. (NASDAQ:PLXS)

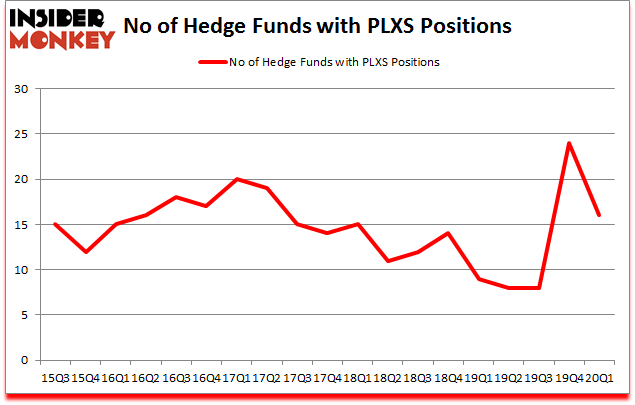

At Q1’s end, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -33% from the previous quarter. The graph below displays the number of hedge funds with bullish position in PLXS over the last 18 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Fisher Asset Management was the largest shareholder of Plexus Corp. (NASDAQ:PLXS), with a stake worth $31.6 million reported as of the end of September. Trailing Fisher Asset Management was Marshall Wace LLP, which amassed a stake valued at $9 million. Winton Capital Management, GLG Partners, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Winton Capital Management allocated the biggest weight to Plexus Corp. (NASDAQ:PLXS), around 0.15% of its 13F portfolio. AlphaCrest Capital Management is also relatively very bullish on the stock, setting aside 0.1 percent of its 13F equity portfolio to PLXS.

Since Plexus Corp. (NASDAQ:PLXS) has faced bearish sentiment from the smart money, it’s safe to say that there were a few fund managers who were dropping their entire stakes in the first quarter. At the top of the heap, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dumped the biggest stake of all the hedgies watched by Insider Monkey, valued at an estimated $3.1 million in stock. Donald Sussman’s fund, Paloma Partners, also dumped its stock, about $1.7 million worth. These moves are important to note, as aggregate hedge fund interest fell by 8 funds in the first quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Plexus Corp. (NASDAQ:PLXS) but similarly valued. These stocks are Turning Point Therapeutics, Inc. (NASDAQ:TPTX), PriceSmart, Inc. (NASDAQ:PSMT), Ping Identity Holding Corp. (NYSE:PING), and WesBanco, Inc. (NASDAQ:WSBC). This group of stocks’ market values are closest to PLXS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPTX | 19 | 360455 | -4 |

| PSMT | 11 | 35029 | -7 |

| PING | 11 | 53376 | 1 |

| WSBC | 9 | 31703 | -2 |

| Average | 12.5 | 120141 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $120 million. That figure was $64 million in PLXS’s case. Turning Point Therapeutics, Inc. (NASDAQ:TPTX) is the most popular stock in this table. On the other hand WesBanco, Inc. (NASDAQ:WSBC) is the least popular one with only 9 bullish hedge fund positions. Plexus Corp. (NASDAQ:PLXS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.3% in 2020 through June 25th but still beat the market by 16.8 percentage points. Hedge funds were also right about betting on PLXS, though not to the same extent, as the stock returned 24.1% during the first two months and twenty five days of the second quarter and outperformed the market as well.

Follow Plexus Corp (NASDAQ:PLXS)

Follow Plexus Corp (NASDAQ:PLXS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.