With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the first quarter. One of these stocks was Plains GP Holdings LP (NYSE:PAGP).

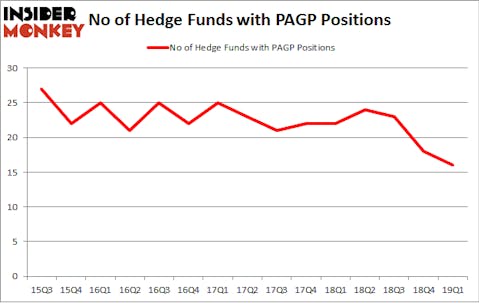

Plains GP Holdings LP (NYSE:PAGP) investors should be aware of a decrease in enthusiasm from smart money of late. PAGP was in 16 hedge funds’ portfolios at the end of the first quarter of 2019. There were 18 hedge funds in our database with PAGP positions at the end of the previous quarter. Our calculations also showed that pagp isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a multitude of tools investors employ to assess publicly traded companies. A duo of the less known tools are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the top money managers can outpace their index-focused peers by a very impressive amount (see the details here).

Joshua Friedman of Canyon Capital

Let’s analyze the recent hedge fund action surrounding Plains GP Holdings LP (NYSE:PAGP).

What does smart money think about Plains GP Holdings LP (NYSE:PAGP)?

Heading into the second quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -11% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in PAGP over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Plains GP Holdings LP (NYSE:PAGP) was held by Canyon Capital Advisors, which reported holding $81.1 million worth of stock at the end of March. It was followed by Deep Basin Capital with a $66.1 million position. Other investors bullish on the company included Point72 Asset Management, Renaissance Technologies, and D E Shaw.

Since Plains GP Holdings LP (NYSE:PAGP) has experienced bearish sentiment from the entirety of the hedge funds we track, logic holds that there exists a select few funds that decided to sell off their full holdings heading into Q3. At the top of the heap, Daniel Arbess’s Perella Weinberg Partners dropped the largest position of all the hedgies monitored by Insider Monkey, valued at about $31.9 million in stock. Jonathan Barrett and Paul Segal’s fund, Luminus Management, also cut its stock, about $3.1 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 2 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Plains GP Holdings LP (NYSE:PAGP) but similarly valued. These stocks are Sterling Bancorp (NYSE:STL), United States Cellular Corporation (NYSE:USM), Wright Medical Group N.V. (NASDAQ:WMGI), and Amedisys Inc (NASDAQ:AMED). This group of stocks’ market caps are similar to PAGP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STL | 19 | 469202 | 1 |

| USM | 14 | 183392 | -3 |

| WMGI | 35 | 889529 | 2 |

| AMED | 26 | 295842 | -6 |

| Average | 23.5 | 459491 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $459 million. That figure was $224 million in PAGP’s case. Wright Medical Group N.V. (NASDAQ:WMGI) is the most popular stock in this table. On the other hand United States Cellular Corporation (NYSE:USM) is the least popular one with only 14 bullish hedge fund positions. Plains GP Holdings LP (NYSE:PAGP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately PAGP wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); PAGP investors were disappointed as the stock returned -1.1% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.