Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

Hedge fund interest in Marriott Vacations Worldwide Corporation (NYSE:VAC) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as J2 Global Inc (NASDAQ:JCOM), Ryman Hospitality Properties, Inc. (NYSE:RHP), and Taro Pharmaceutical Industries Ltd. (NYSE:TARO) to gather more data points.

To most stock holders, hedge funds are perceived as slow, old investment tools of years past. While there are greater than 8000 funds trading at present, We choose to focus on the aristocrats of this club, about 750 funds. These money managers administer most of the smart money’s total capital, and by following their inimitable investments, Insider Monkey has uncovered a number of investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a look at the new hedge fund action regarding Marriott Vacations Worldwide Corporation (NYSE:VAC).

Hedge fund activity in Marriott Vacations Worldwide Corporation (NYSE:VAC)

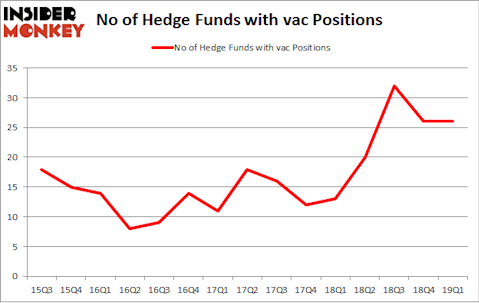

Heading into the second quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards VAC over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Rima Senvest Management held the most valuable stake in Marriott Vacations Worldwide Corporation (NYSE:VAC), which was worth $181.7 million at the end of the first quarter. On the second spot was Nantahala Capital Management which amassed $57.3 million worth of shares. Moreover, Waratah Capital Advisors, Newbrook Capital Advisors, and Point72 Asset Management were also bullish on Marriott Vacations Worldwide Corporation (NYSE:VAC), allocating a large percentage of their portfolios to this stock.

Seeing as Marriott Vacations Worldwide Corporation (NYSE:VAC) has experienced bearish sentiment from the entirety of the hedge funds we track, we can see that there is a sect of funds who sold off their full holdings by the end of the third quarter. Intriguingly, John Khoury’s Long Pond Capital said goodbye to the biggest position of all the hedgies monitored by Insider Monkey, comprising about $15.1 million in call options. Jeffrey Pierce’s fund, Snow Park Capital Partners, also dumped its call options, about $4.4 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Marriott Vacations Worldwide Corporation (NYSE:VAC) but similarly valued. We will take a look at J2 Global Inc (NASDAQ:JCOM), Ryman Hospitality Properties, Inc. (NYSE:RHP), Taro Pharmaceutical Industries Ltd. (NYSE:TARO), and The Goodyear Tire & Rubber Company (NASDAQ:GT). This group of stocks’ market valuations are similar to VAC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JCOM | 22 | 264086 | 5 |

| RHP | 18 | 477090 | 0 |

| TARO | 10 | 74462 | 2 |

| GT | 19 | 348140 | -11 |

| Average | 17.25 | 290945 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $291 million. That figure was $400 million in VAC’s case. J2 Global Inc (NASDAQ:JCOM) is the most popular stock in this table. On the other hand Taro Pharmaceutical Industries Ltd. (NYSE:TARO) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Marriott Vacations Worldwide Corporation (NYSE:VAC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on VAC, though not to the same extent, as the stock returned -1% during the same period and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.